Switching to Gimbla

The process of switching from one accounting software to another can be complex. So take your time to get it right the first time when you need to enter the opening balances.

There are three parts to consider when entering the opening balance. You can skip any parts where your starting balance is zero.

- Part A - Customer and Supplier’s Balance

- Part B - General Account Balance

- Part C - Bank Balance

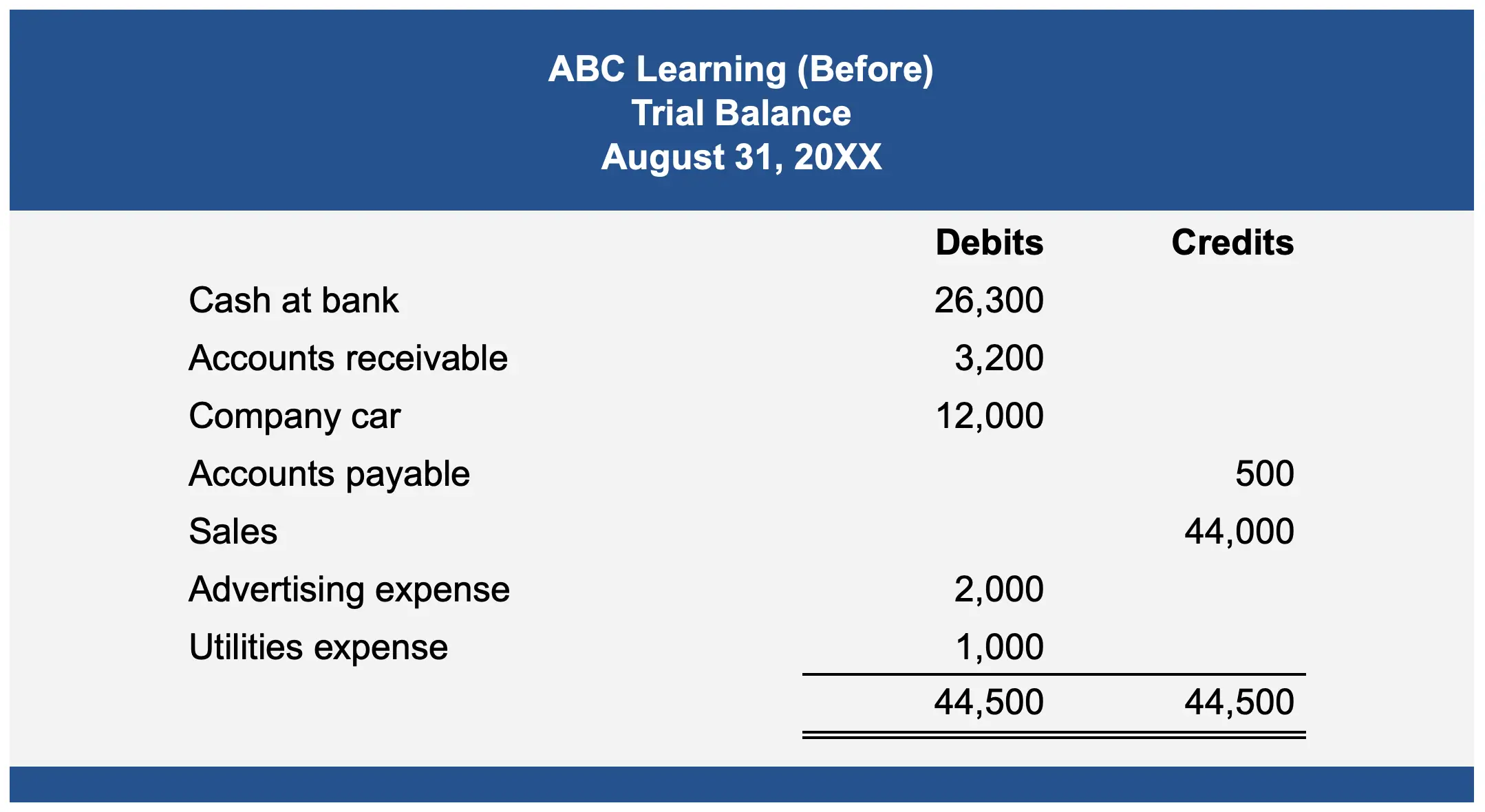

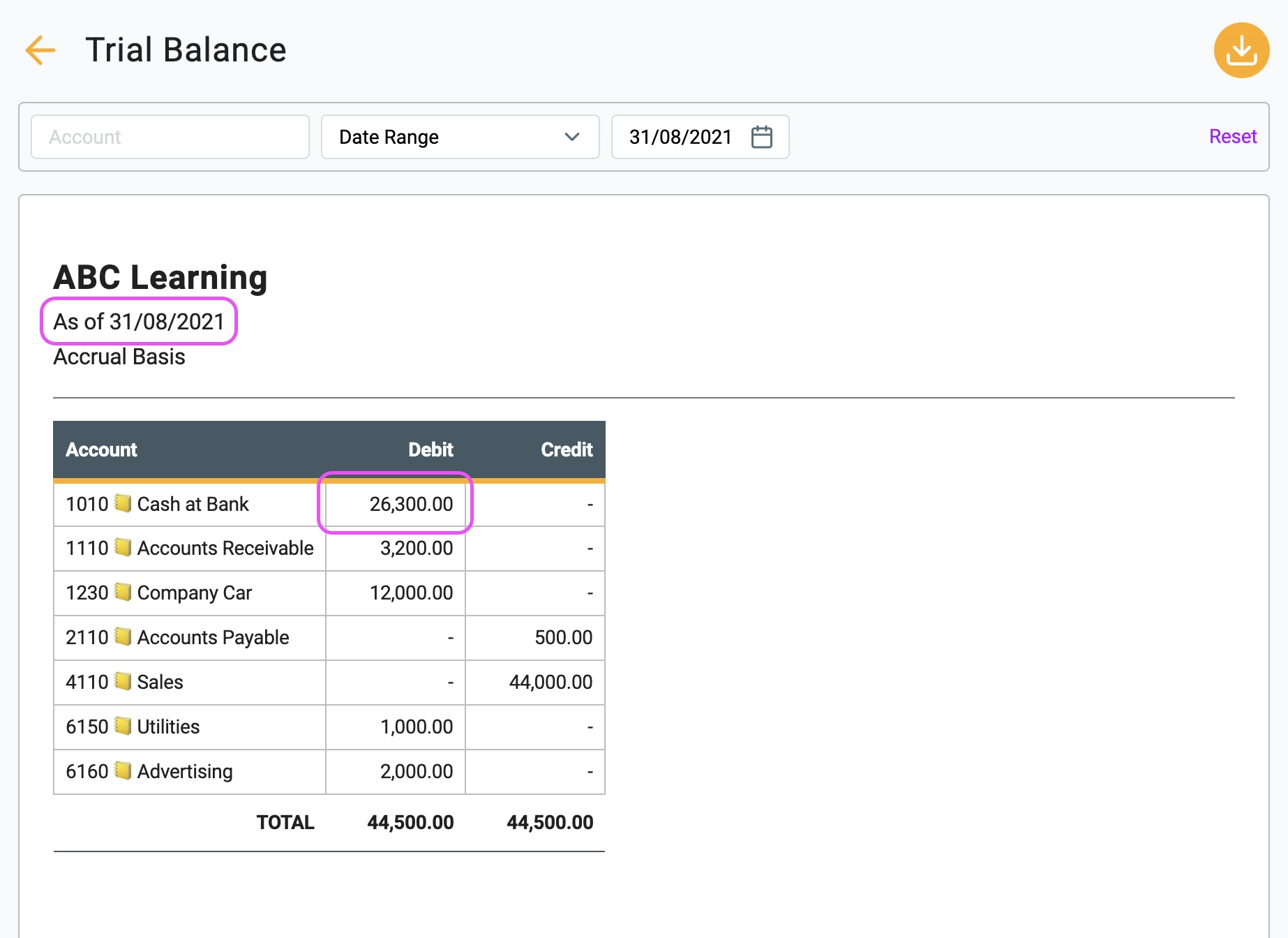

Before you start, run a Trial Balance from your old accounting software to the end of the month you wish to transfer over. In our example, we will use the 31st August.

It’s also a good idea to save a copy of the Balance Sheet and Profit and Loss statements to compare the reports for the same period to ensure you have included everything.

Part A - Customer and Supplier’s Balance

1 - Create any unpaid invoices and/or bills

Unpaid invoices/bills are your customer and supplier’s opening balances. Manually create those in Gimbla. Only enter the outstanding amount. For instance, if your invoice is $100 and $30 has been paid, then enter $70 in Gimbla. Invoice date, due date and all the other information should be the same.

2 - Delete the unpaid invoices and/or bills

With the unpaid invoices/bills entered in Gimbla, you can now delete them from your previous accounting software. If the invoice is partially paid, as in the example above, then change the original invoice to $30 so the other unpaid $70 is removed. If you can’t change the invoice then create a credit note to offset this amount.

Part B - General Account Balance

3 - Amend the Chart Of Accounts

Your Trial Balance should list all the charts of accounts with their balances. At this stage, make sure the chart of accounts in Gimbla is similar to that in the old system. If not, make the changes as required now.

4 - Run another Trial Balance

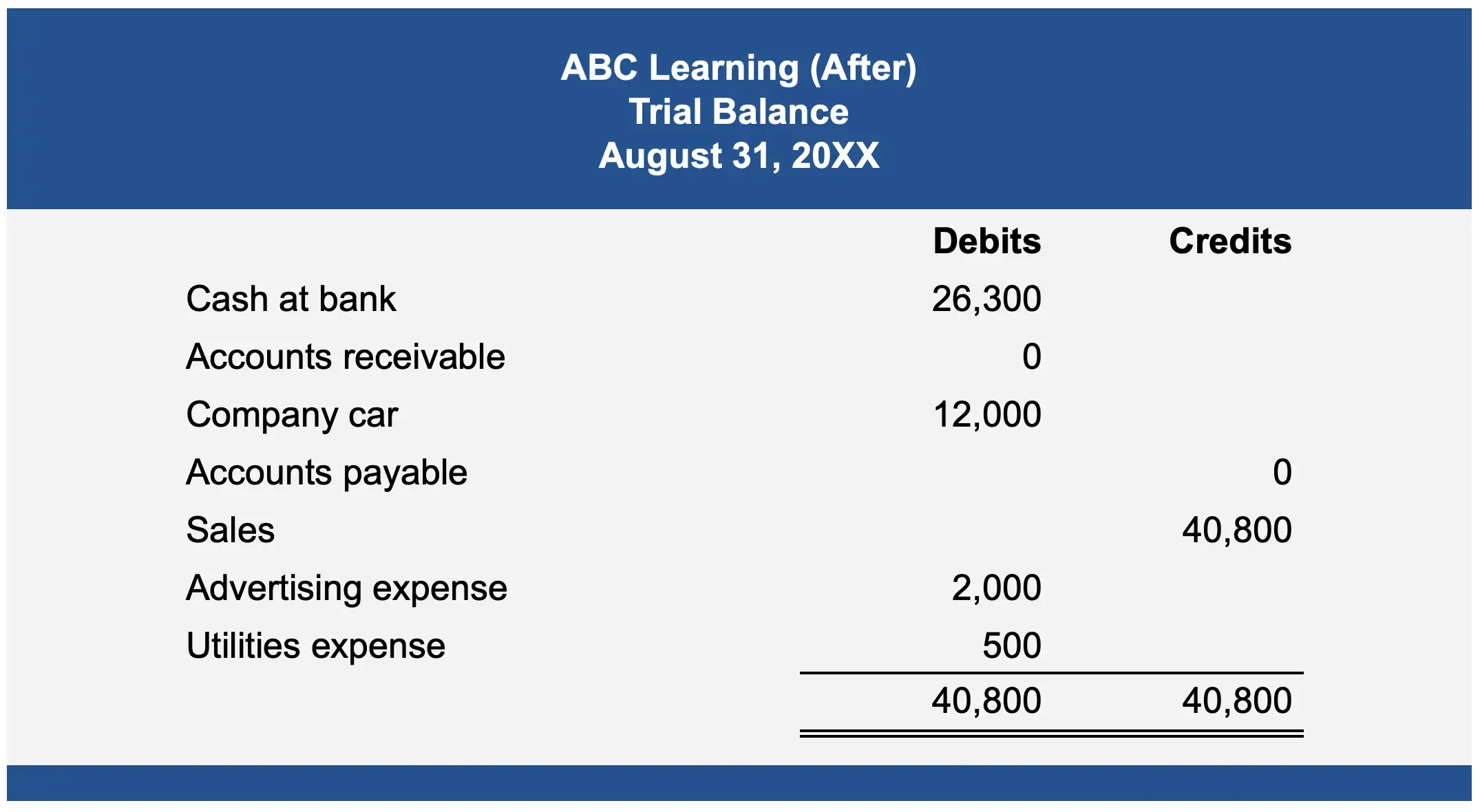

Run another Trial Balance to get the amount without the unpaid invoices/bills. Accounts payable or receivable should be zero now in the Updated Trial Balance.

5 - Create the journal entry

Navigate to the journal entry section of Gimbla and create a journal so it matches the figure in your Updated Trial Balance. Remember to use the same ending date for the journal. Note that we have replaced the ‘Cash at bank’ asset account with the 'Owner's Capital’ equity account. We can use the equity account to temporarily hold an amount and offset it later on in Part C.

Part C - Bank Balance

6 - Adjust the bank balance

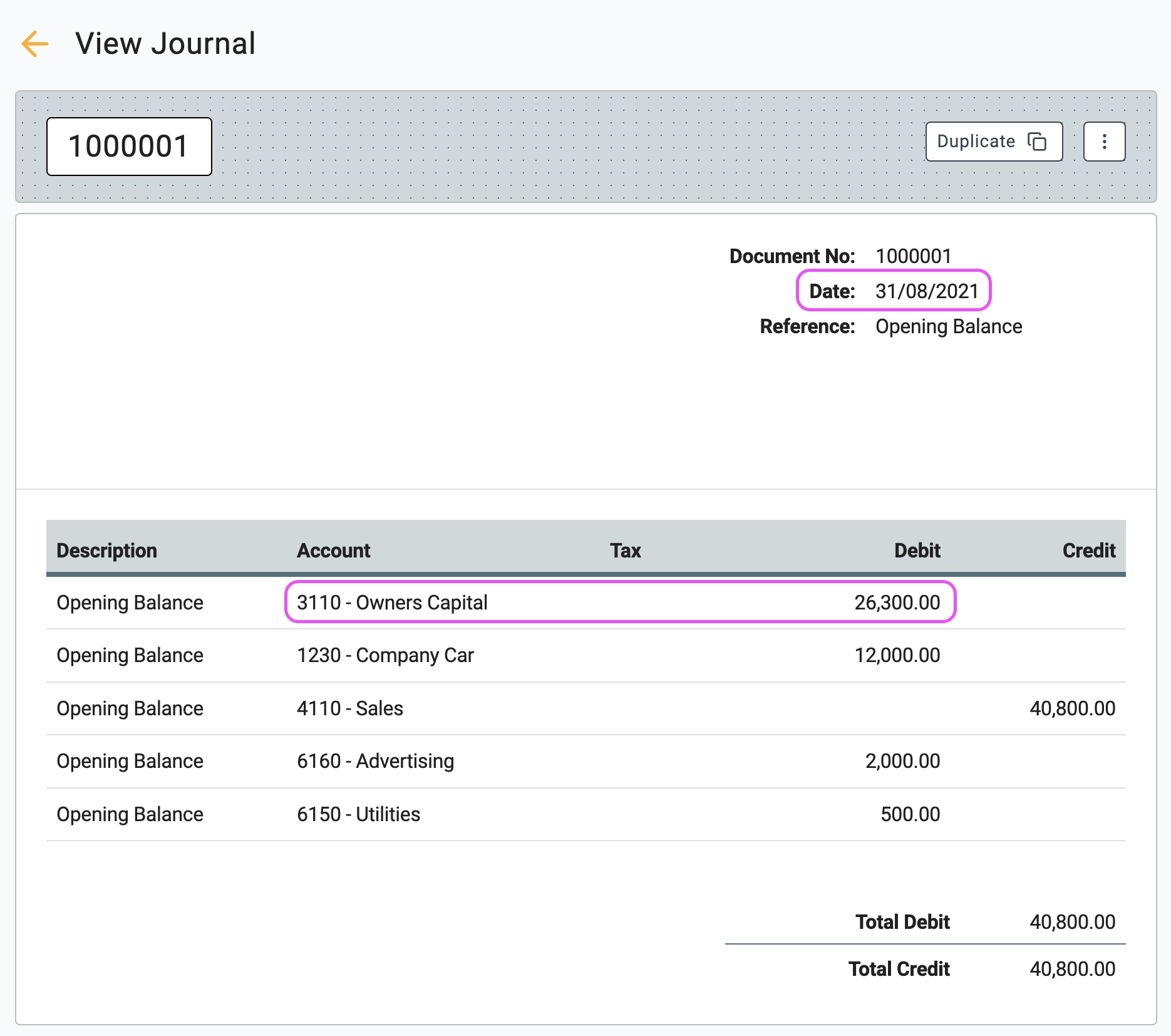

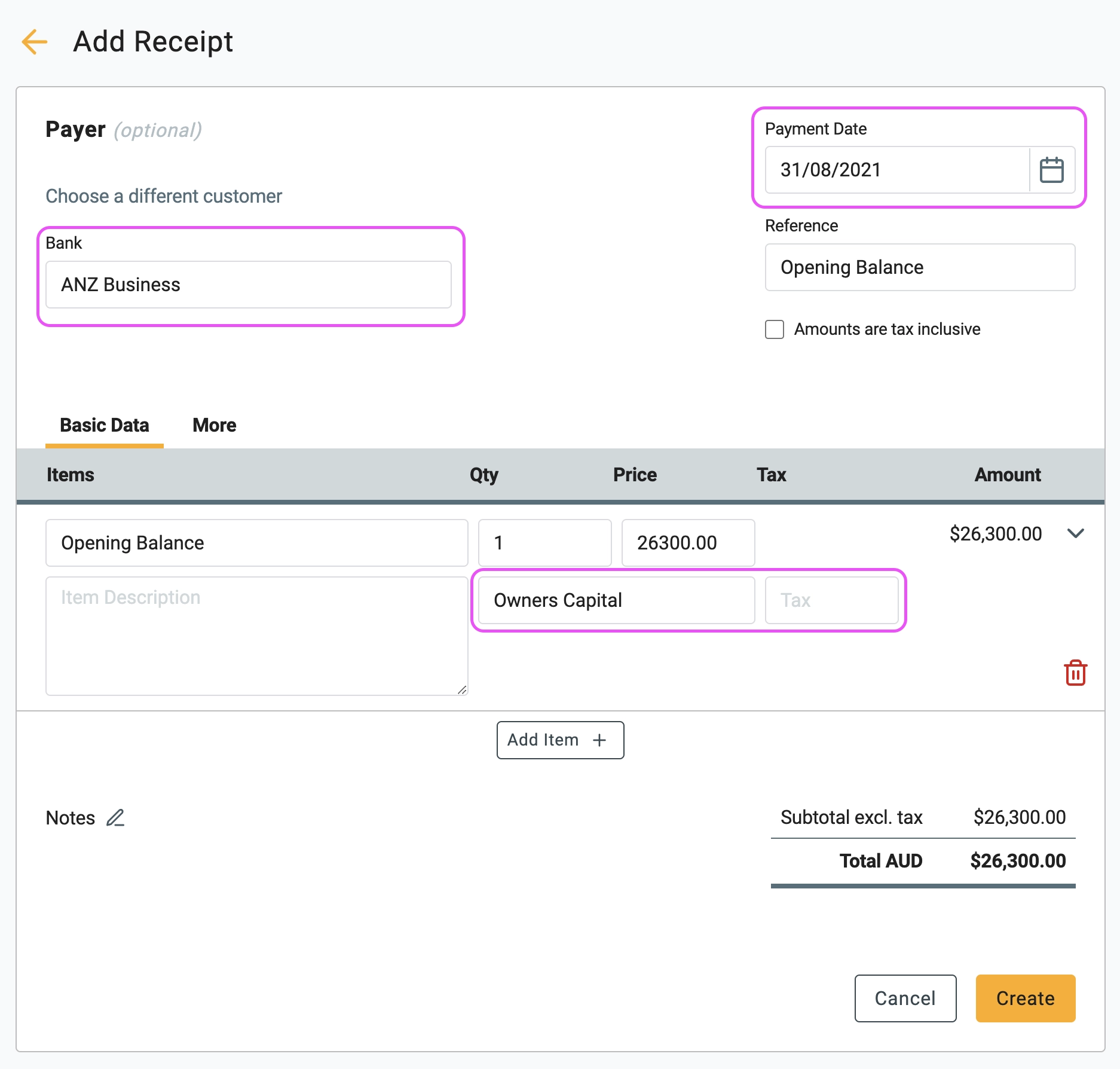

Gimbla uses a control account for your bank balance. This enables bank reconciliation and creating bank rules to automate statement imports. We will need to enter them in a different way.

To update your bank balance, you will need to create a ‘Receipt’ transaction. This will change both the amount in your Trial Balance and the Bank Balance.

Continuing with our example, this receipt will add in the required opening balances and offset the equity account as per our 1st journal.

8 - Compare trial balances

If you have done everything correctly, your Trial Balance in Gimbla should be the same as the previous accounting system with the unpaid invoices included. The Balance Sheet and Profit and Loss statements should also be the same at the end of month.

Congratulations for making it this far. 🎉 You can now continue to carry on using Gimbla Accounting Software in a much simpler way.