Depreciation

This guide dives into the concept of depreciation, a fundamental accounting principle that allocates the cost of an asset over its useful life.

To understand how this works, we will explore a practical example involving two purchases: a Macbook Air ($2 ,000 ) and a Fountain Pen ($70). The key difference lies in how we treat these purchases in your financial statements based on their value and lifespan.

🧭 Navigate To

👣 Walkthrough

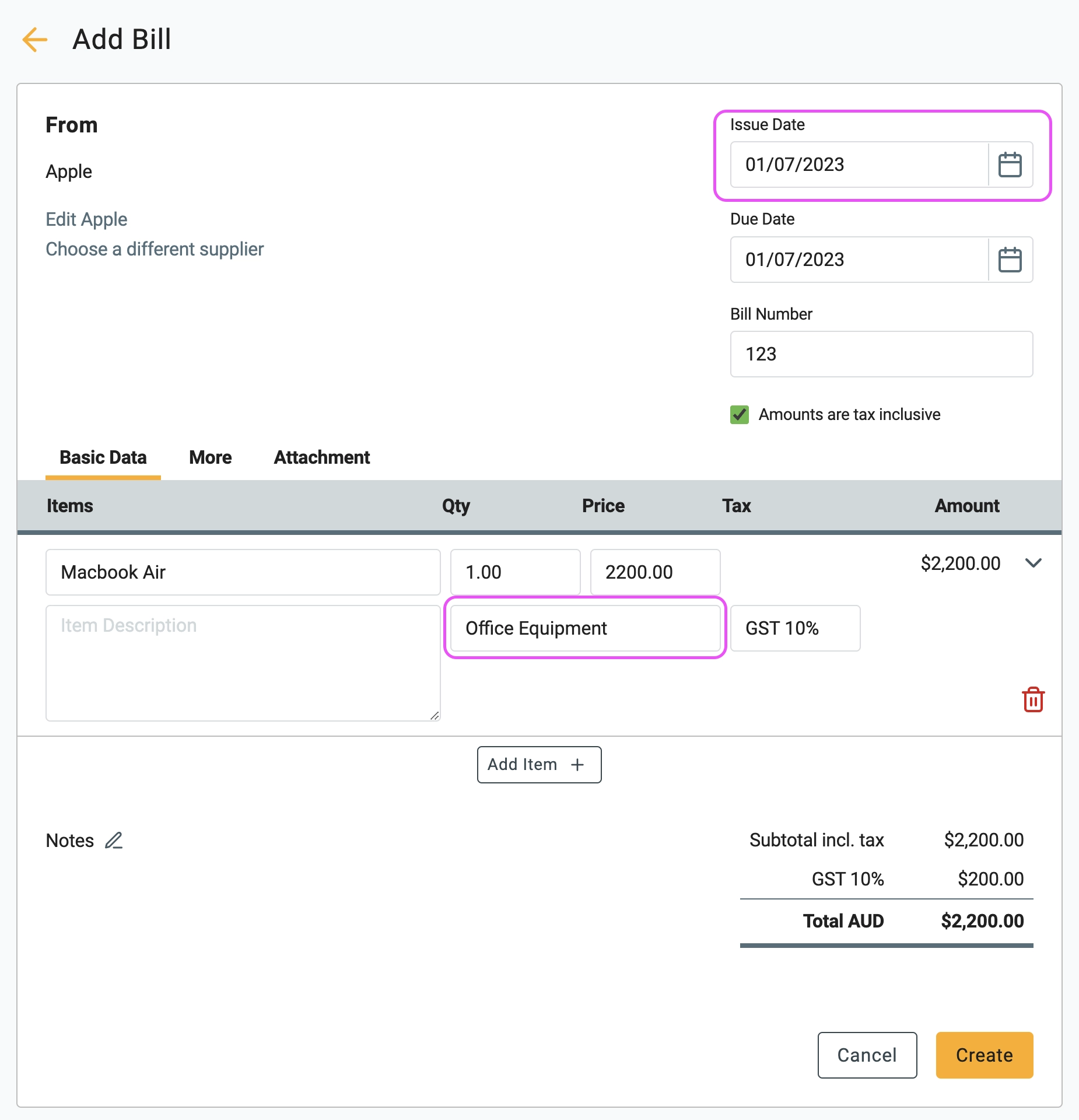

1 First, we need to record the purchases. When entering the bill for the Macbook Air ($2,000), map it to a Non-current Asset account (e.g., "Office Equipment"). Because it is a high-value asset, it is not an immediate expense.

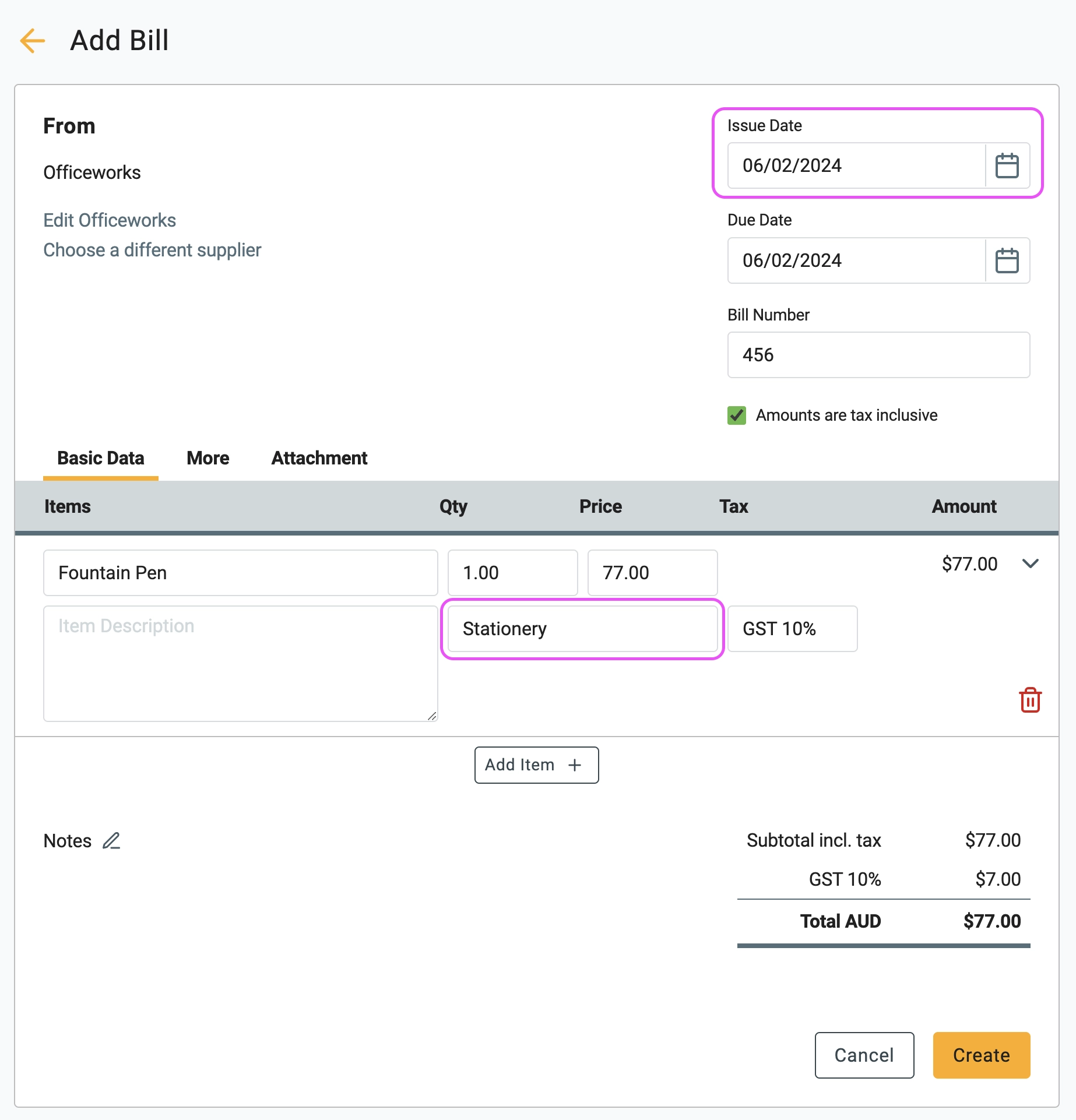

2 Next, enter the bill for the Fountain Pen ($70). Since the cost is low (typically under $300), map this directly to an Expense account (e.g., "Stationery"). This cost is written off immediately.

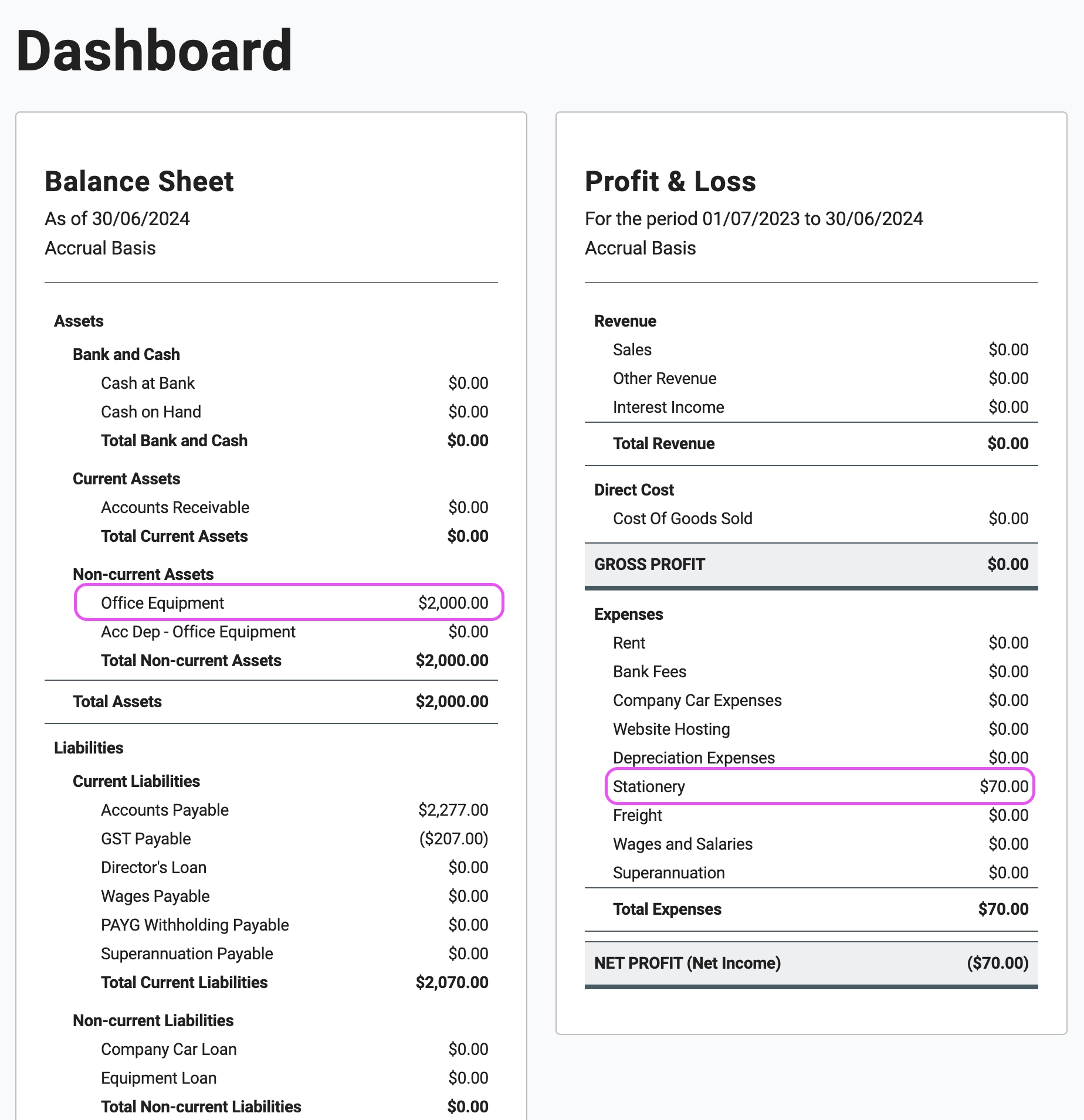

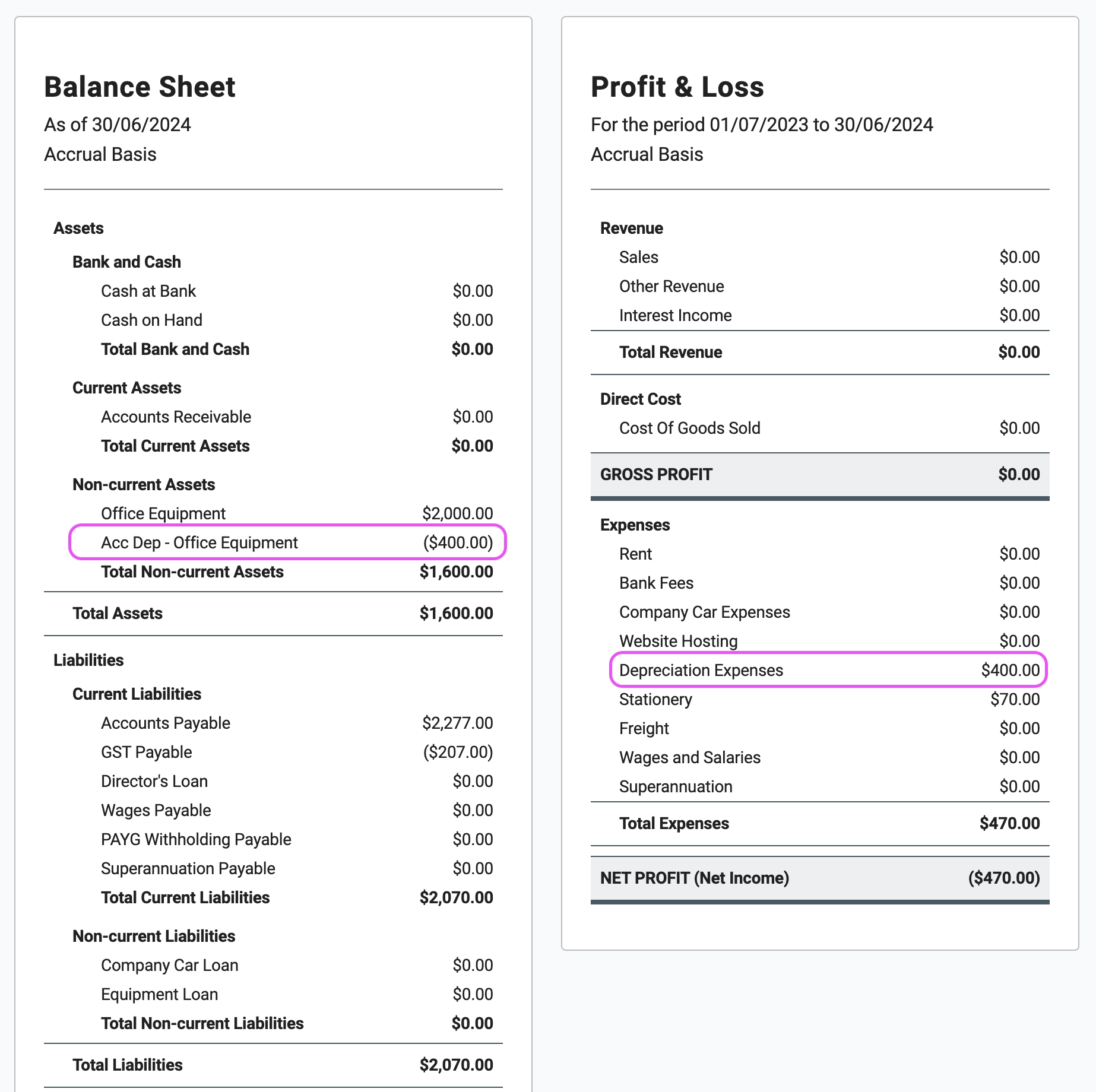

3 Before depreciating, check your reports. You will see the $70 sitting in the Profit and Loss as a expense, while the $2,000 sits on the Balance Sheet as an asset.

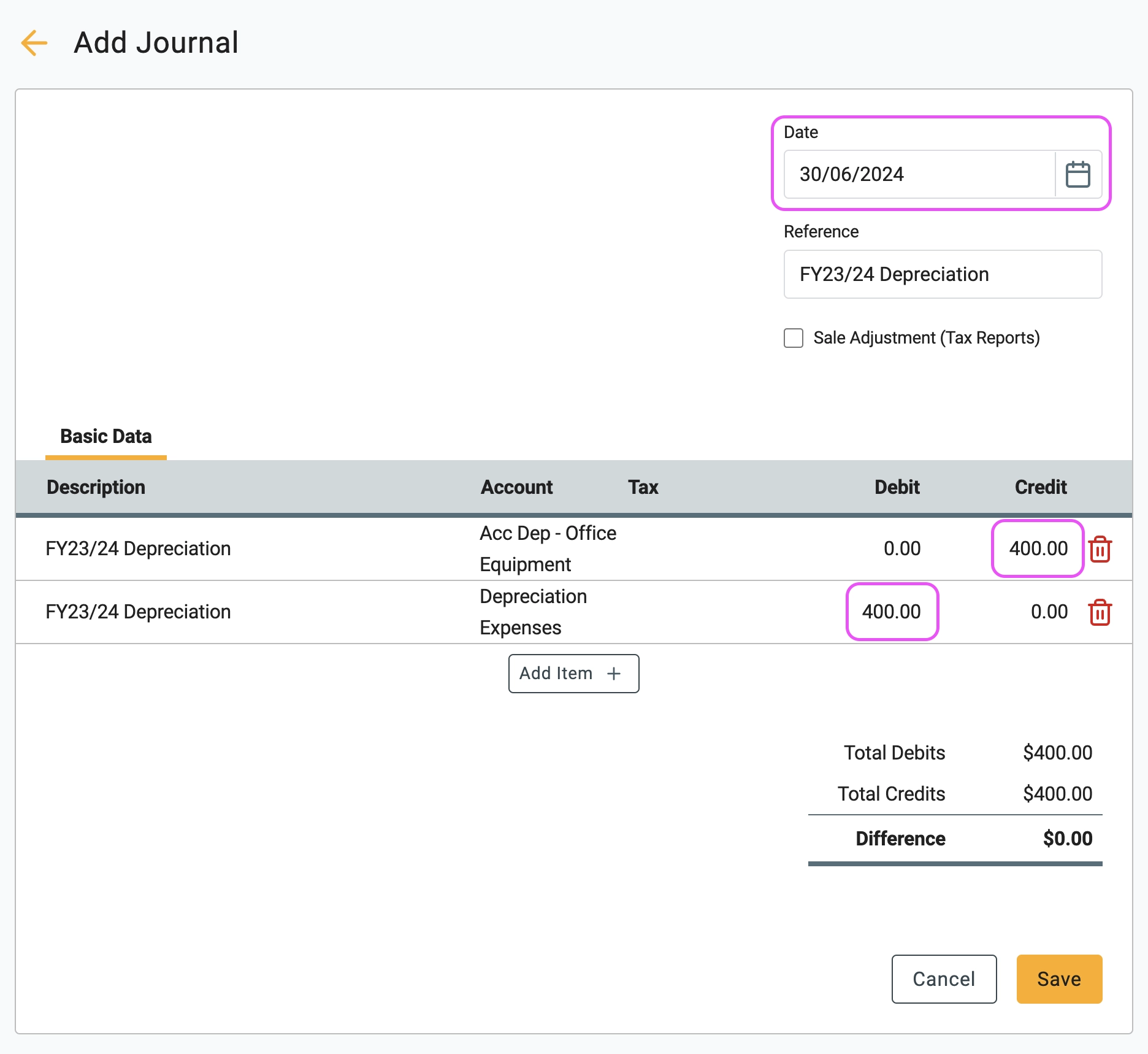

4 To record the wear and tear on the Macbook, we must create a Journal Entry. For this example, we will depreciate $400 for the year.

- Debit: – Depreciation Expenses ($400)

- Credit: – Acc Dep - Office Equipment ($400)

- Ensure the tax field is left empty.

🏁 Results

Take another look at both the "Balance Sheet" and "Profit and Loss" statements. You'll see that the $400 has become depreciation expenses, making the total expenses for the year $470. Keep doing this every year until the asset's value reaches $0.00.

🖇️ Notes

Take a minute to review the accounting principles applied here. A brief description of the key concepts follows:

- Expense vs. Asset – Small items (like the pen) are expensed immediately, reducing profit right away. Large assets (like the laptop) retain their value on the Balance Sheet and are expensed slowly over time.

- The Journal Entry – By Debiting "Depreciation Expenses," you increase your expenses for the year. By Crediting "Accumulated Depreciation," you lower the book value of the asset on the Balance Sheet without removing the original cost.

- Pro-Rata Calculation – If you start using an asset halfway through the financial year, you should only journal a portion of the yearly depreciation amount to account for the actual days used.

▶️ Video Tutorial

If you are a visual learner, check out our short video walkthrough on how to handle depreciation in Gimbla.