GST, VAT and Sales Tax

This guide will walk you through how to generate tax reports and clear tax liabilities in your Gimbla account.

A consumption tax is a tax on the sale of goods or services. Around the world, it is referred to by different names (GST, VAT, Sales Tax) and percentages.

The purpose of this guide is to show you how to generate the tax report for your reporting period, determine your net position, and record the payment to clear it from your accounting system.

🧭 Navigate To

👣 Walkthrough

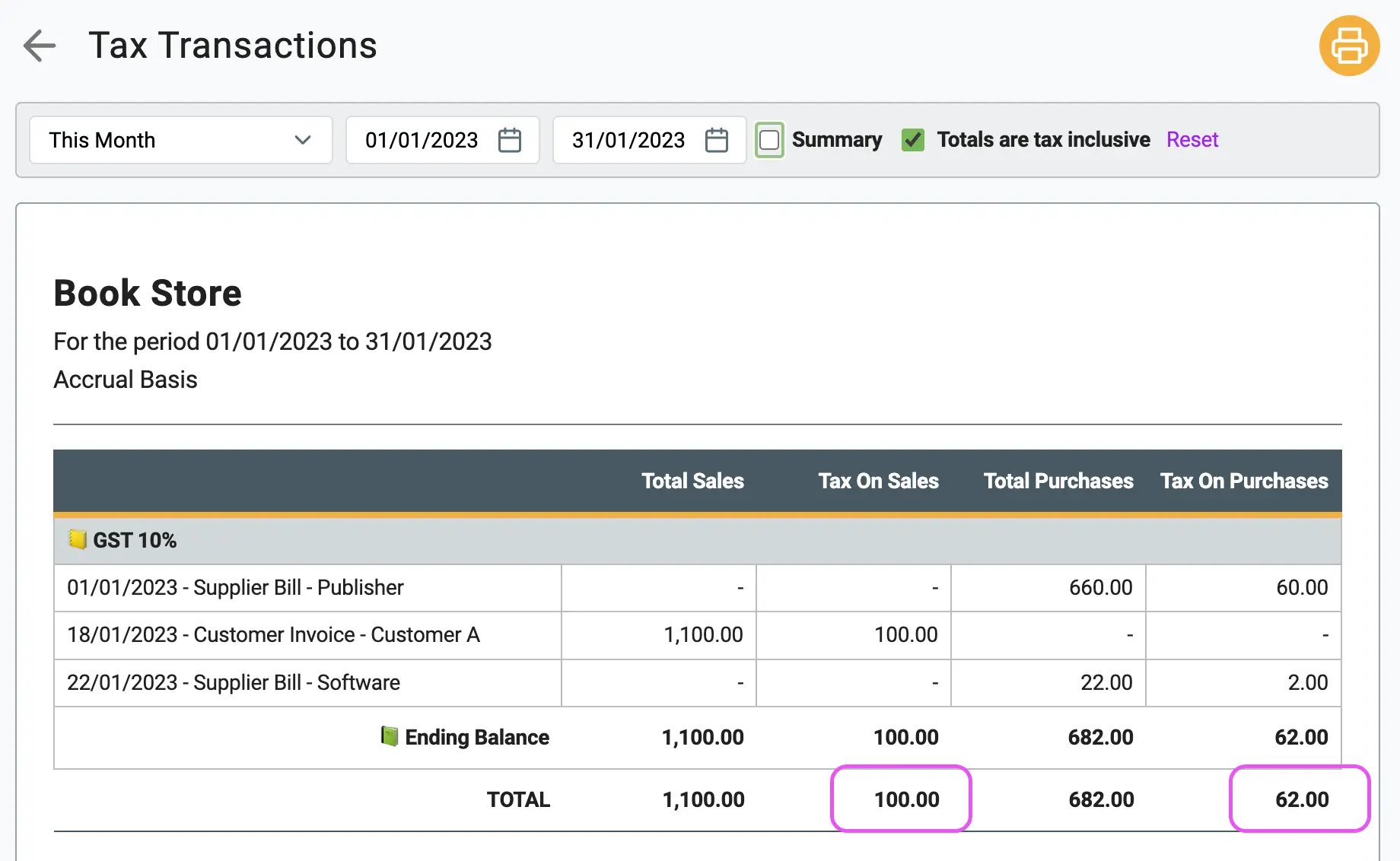

1 The first step is to run the Tax Transactions report for your specific period (e.g., This Month or This Quarter). You need to compare the total taxes collected on Sales against the total taxes paid on Purchases.

- If Sales Tax > Purchase Tax, you generally owe the difference to the tax authority.

- If Purchase Tax > Sales Tax, you generally receive a refund.

2 Once you have determined the amount to pay (in this example,

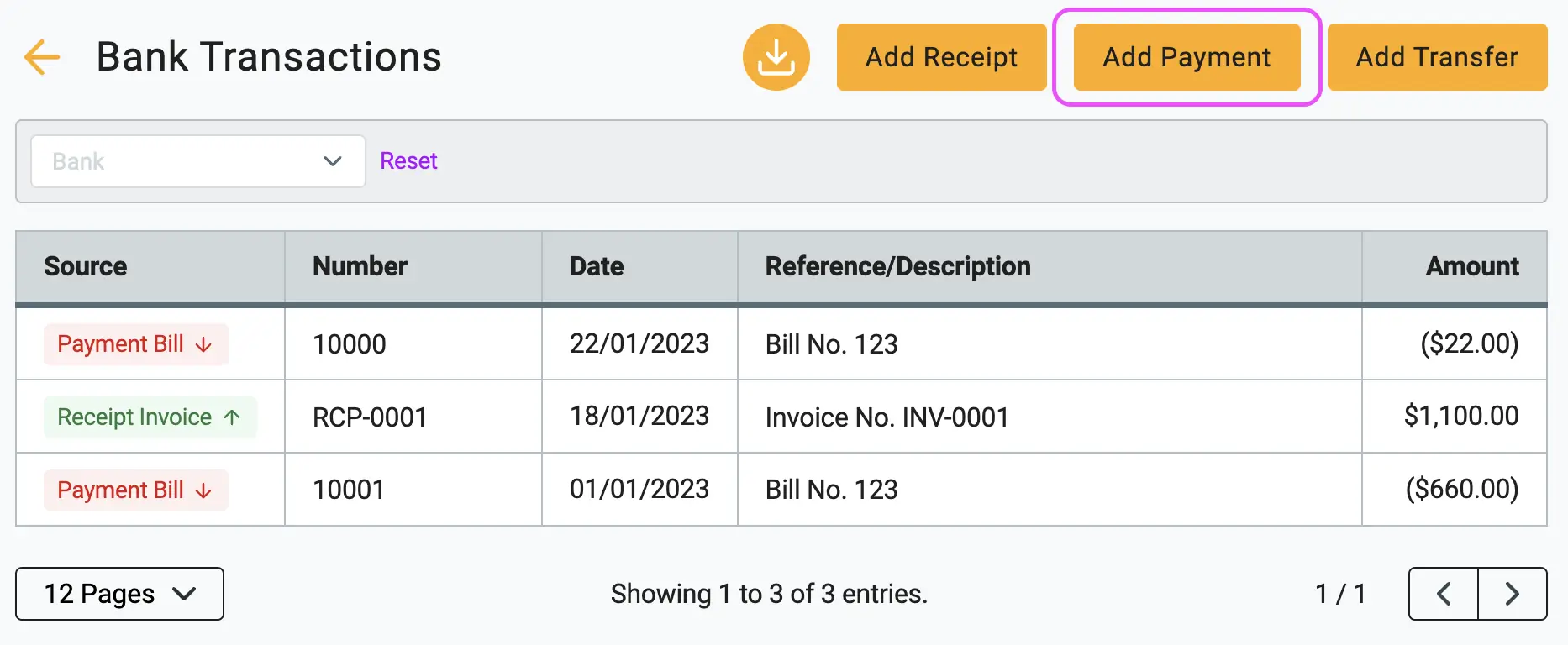

we owe money to the ATO), navigate to the Bank Transactions section.

Click on Make Payment

to record the transaction paying back the

difference.

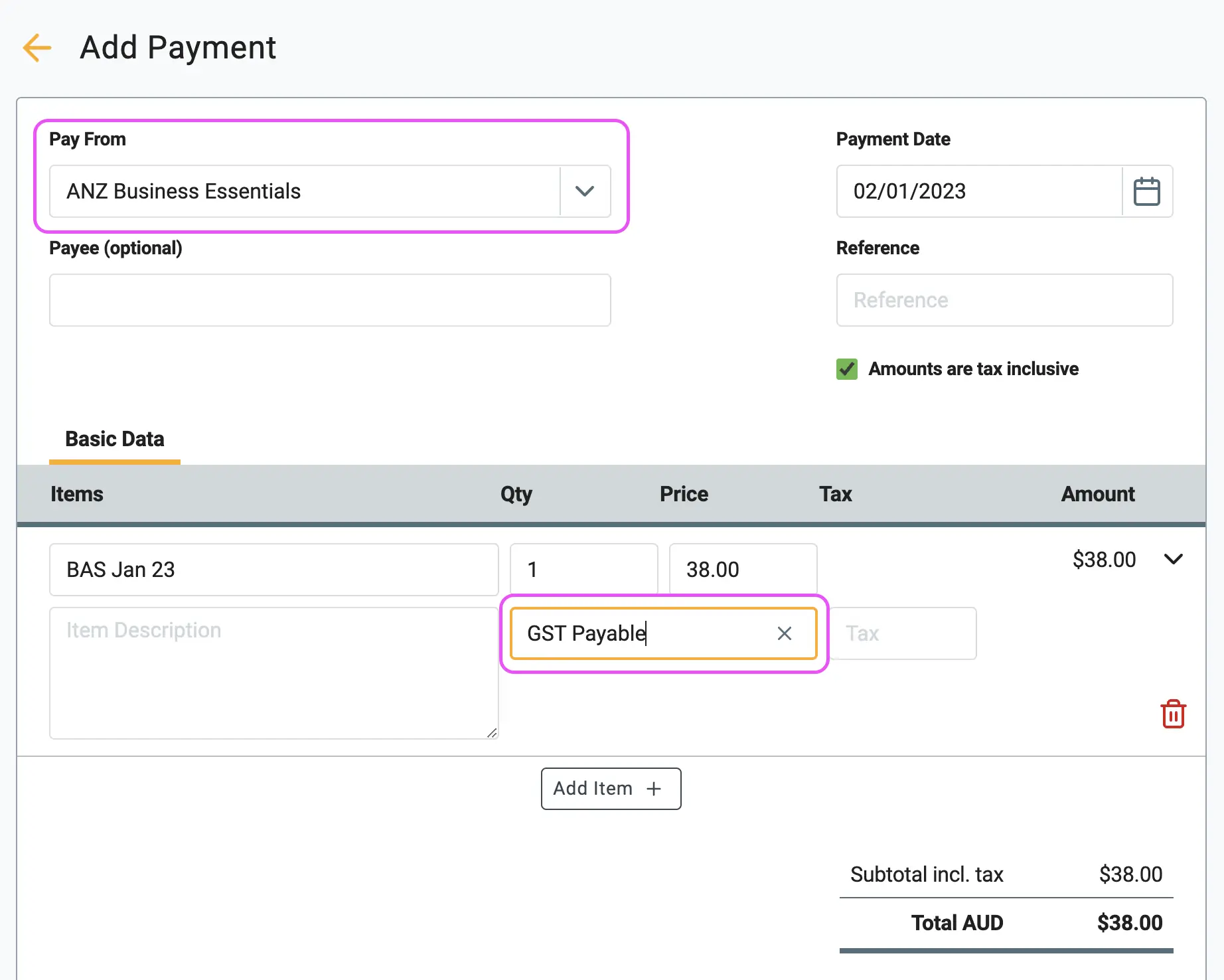

3 In the payment form, enter the details including the Date, Payee, and Amount. Crucially, you must select the GST Payable (or VAT/Sales Tax Payable) account in the item line. This ensures the payment is offset against the tax liability sitting in your ledger.

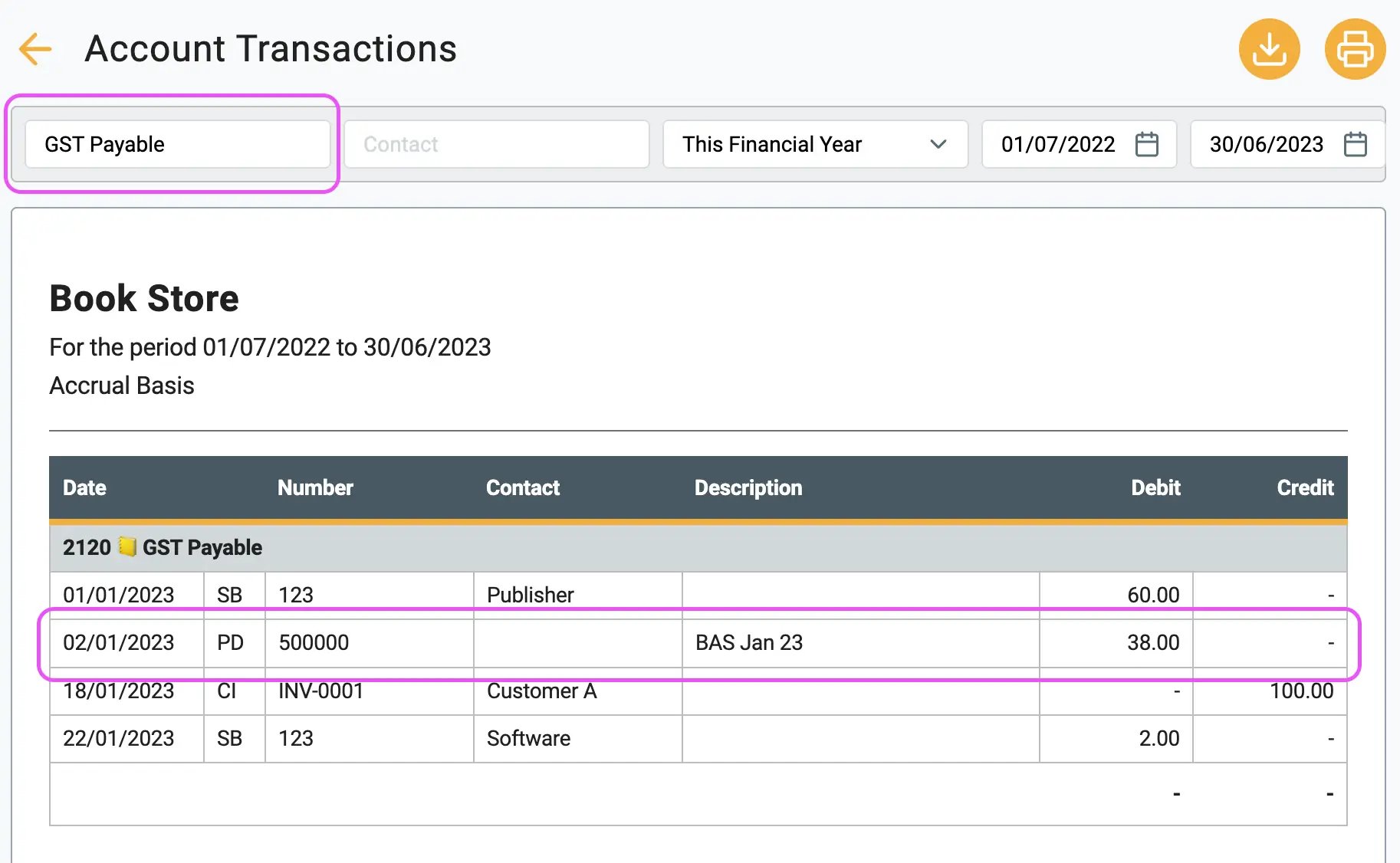

4 After creating the payment, you can verify that the process

is complete. If you filter your Account Transactions by the GST Payable

account.

🏁 Results

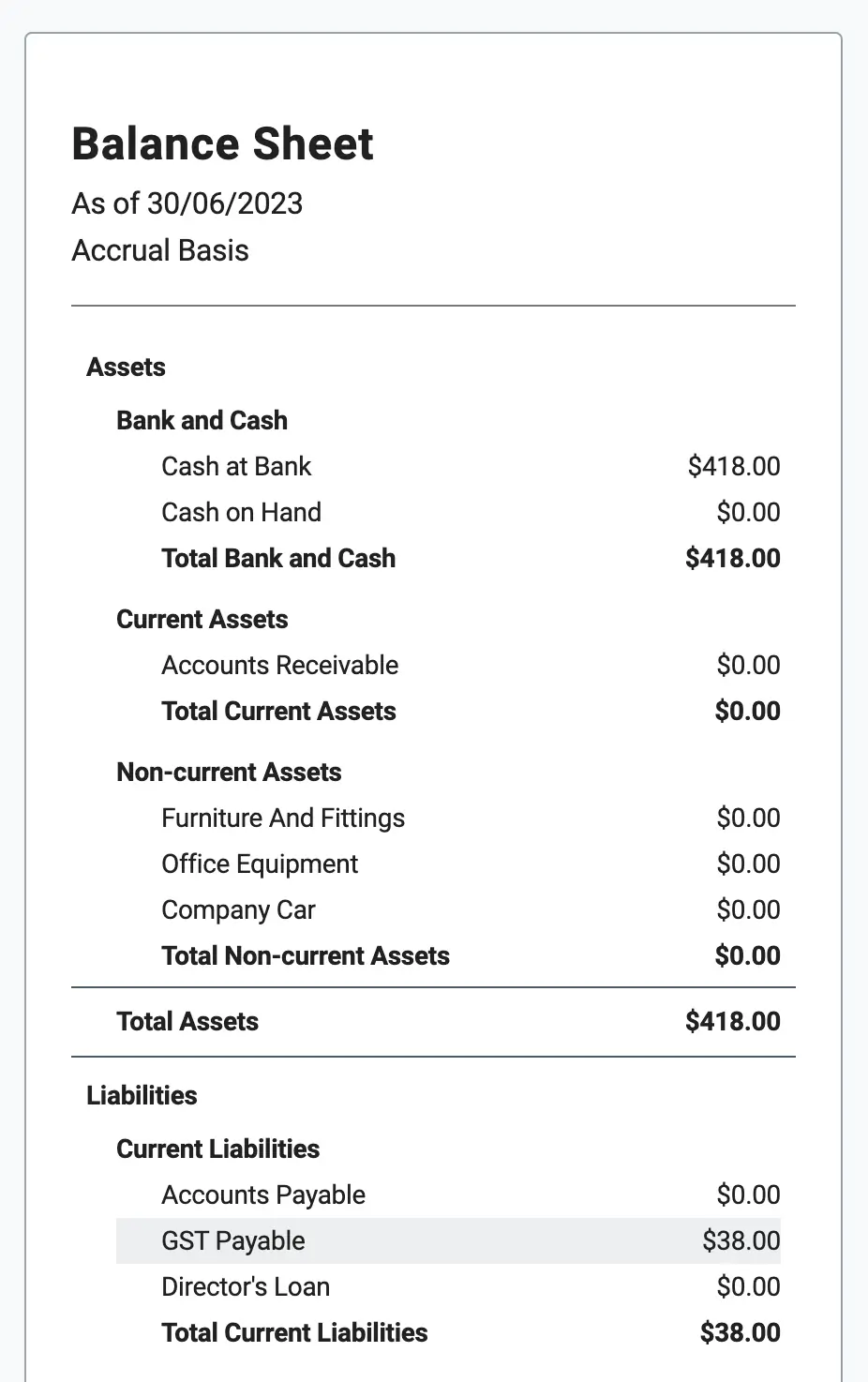

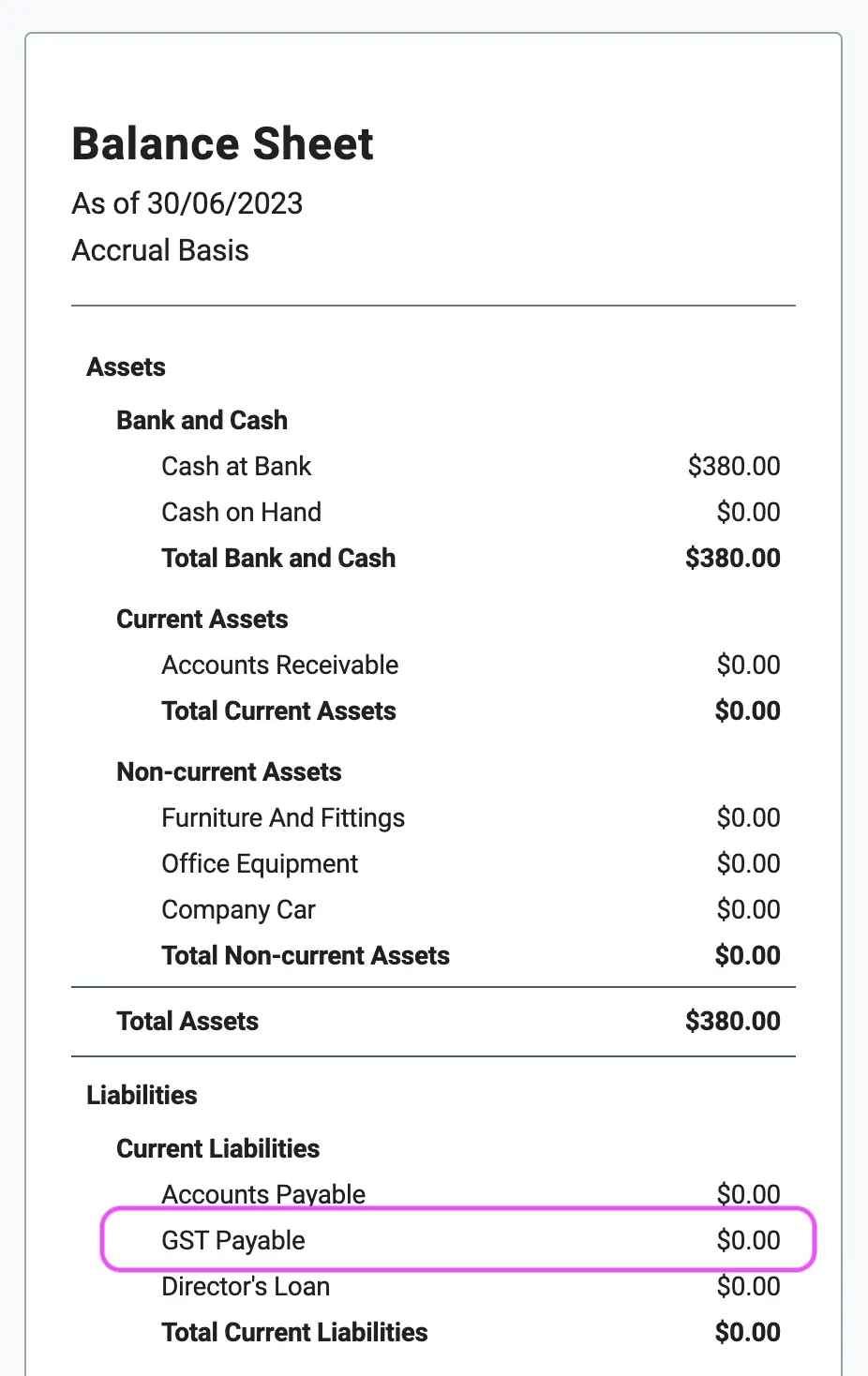

You can confirm this by looking at your Balance Sheet report. In the GST Payable account, there is now a zero balance.

| Before Payment | After Payment |

|---|---|

|  |

🖇️ Notes

Take a minute to review the following points regarding tax reporting and clearing accounts. A brief description of the key behaviors follows:

- Jurisdiction Naming

– While this guide uses the term

GST

and references the Australian Taxation Office (ATO), the same principle applies to VAT (Value Added Tax) and Sales Tax jurisdictions globally. - Net Position – You are only paying (or receiving) the difference between what you collected from customers and what you paid to suppliers.

- The Clearing Account – Selecting the

GST Payable

account during the payment step is the most important part of this process. If you select a generic expense account, your Balance Sheet will still show that you owe tax. - Zero Balance – The ultimate goal after filing your return and making payment is for your tax liability account on the Balance Sheet to return to $0.00 for that period.

▶️ Video Tutorial

If you are a visual learner, check out our short video walkthrough on how to manage tax reporting in Gimbla.