Record an overpayment

Sometimes, a customer might pay more than the amount on their

invoice. When this happens, Gimbla makes it easy to record the extra

money (the overpayment

) so you can either refund it to the

customer or apply it to their future invoices.

🧭 Navigate To

👣 Walkthrough

For this example, we assume a customer has paid $150 for a $110 invoice, resulting in a $40 overpayment.

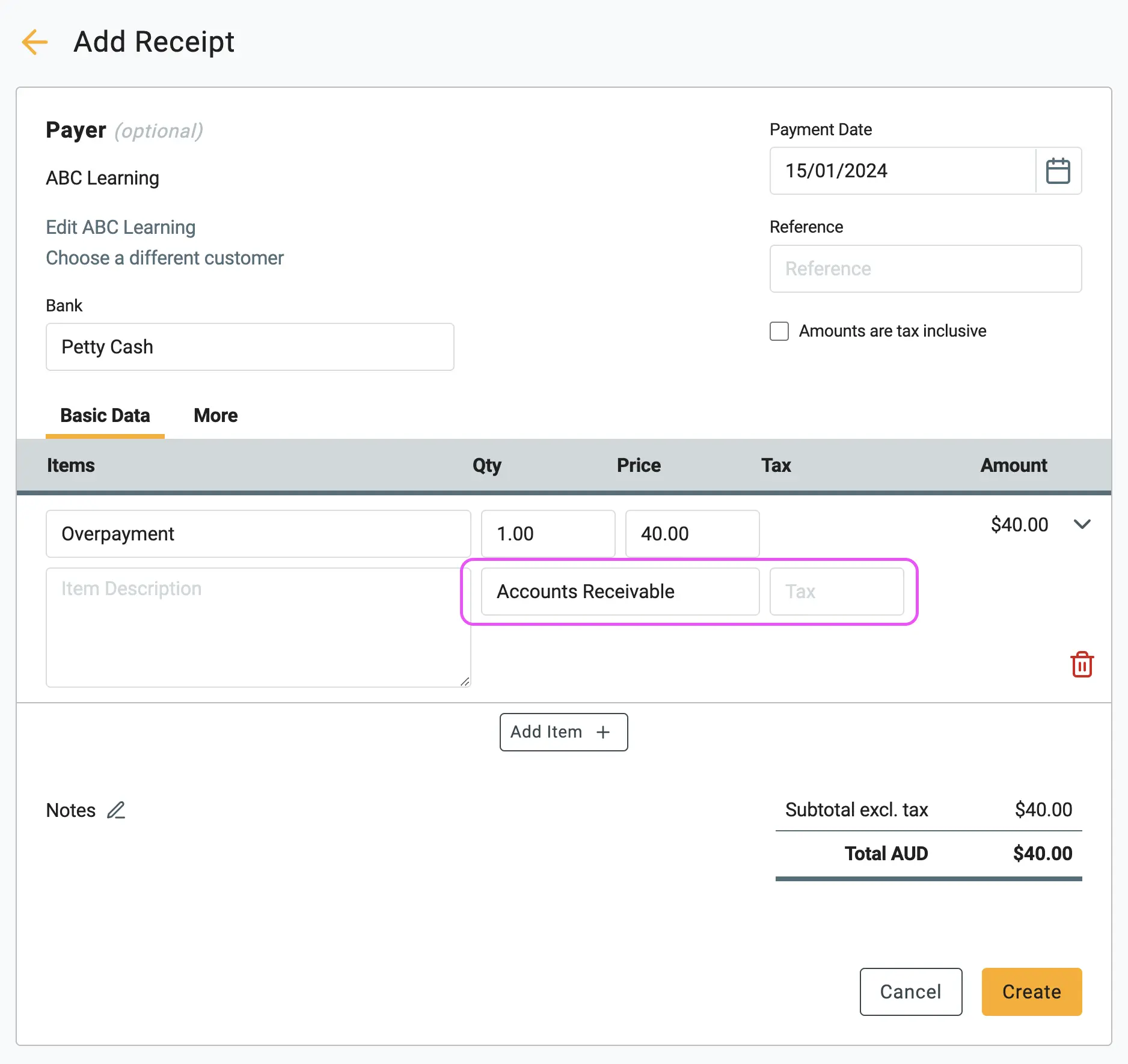

1 Find and open the invoice the customer was paying (in our example,

the $110 invoice). In the top menu, click the Add Receipt

button.

2 In the receipt window, type in the total amount the customer

actually gave you (e.g., $150). Gimbla will automatically detect the extra

money and display an Overpayment

box, warning you that it is going

to create a $40 overpayment document. Click Add

to confirm.

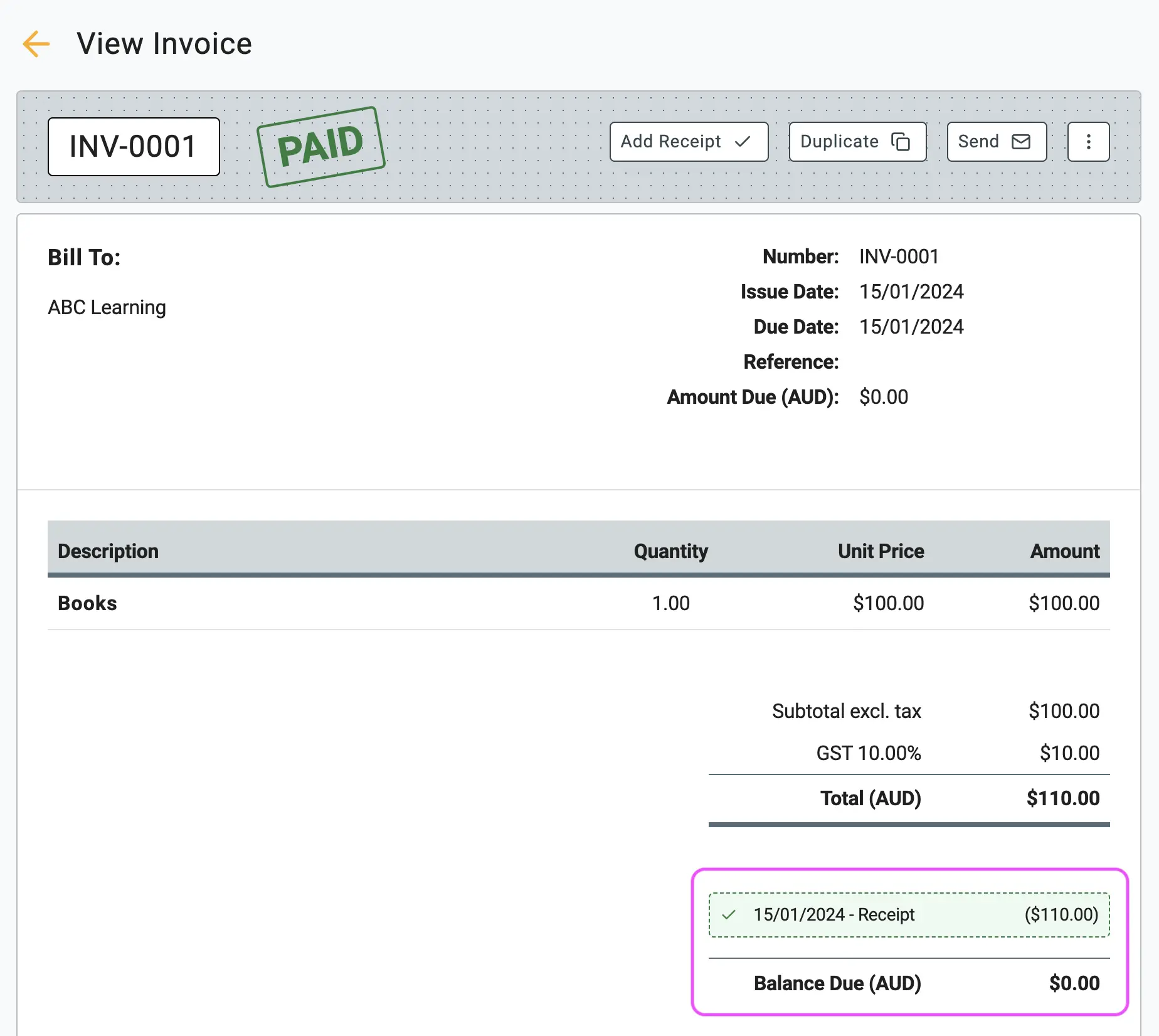

3 If you look at your main Invoices list, you will now see two things:

-

The original invoice is fully settled and marked as

Paid

. -

A new overpayment document has been created for the extra $40,

marked as

Unpaid

(which means the credit is sitting there waiting to be used).

4 You can confirm the details by checking your Account Transactions. You will notice that Gimbla cleanly separates the total payment into two distinct amounts: the $110 invoice payment and the $40 overpayment.

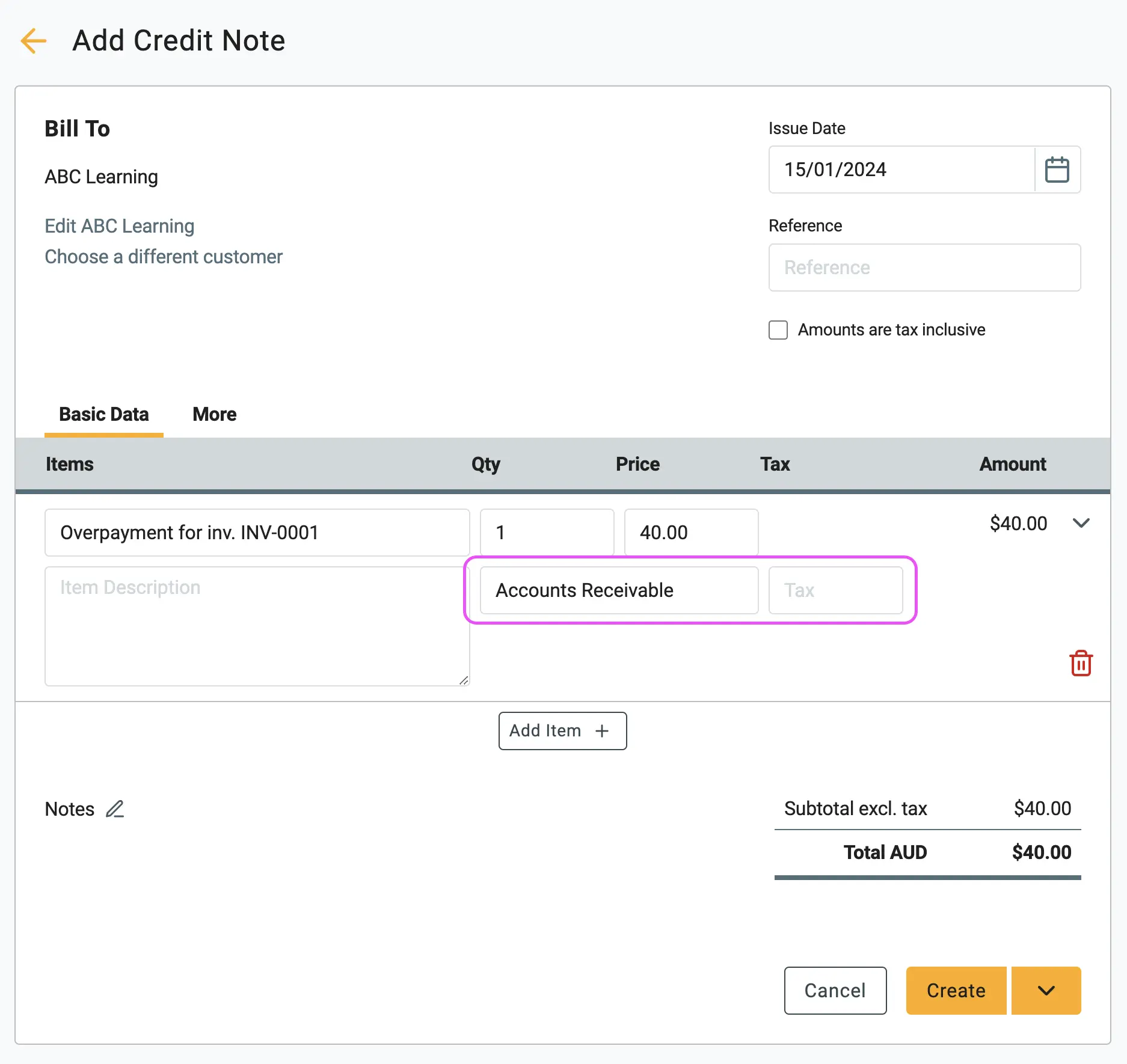

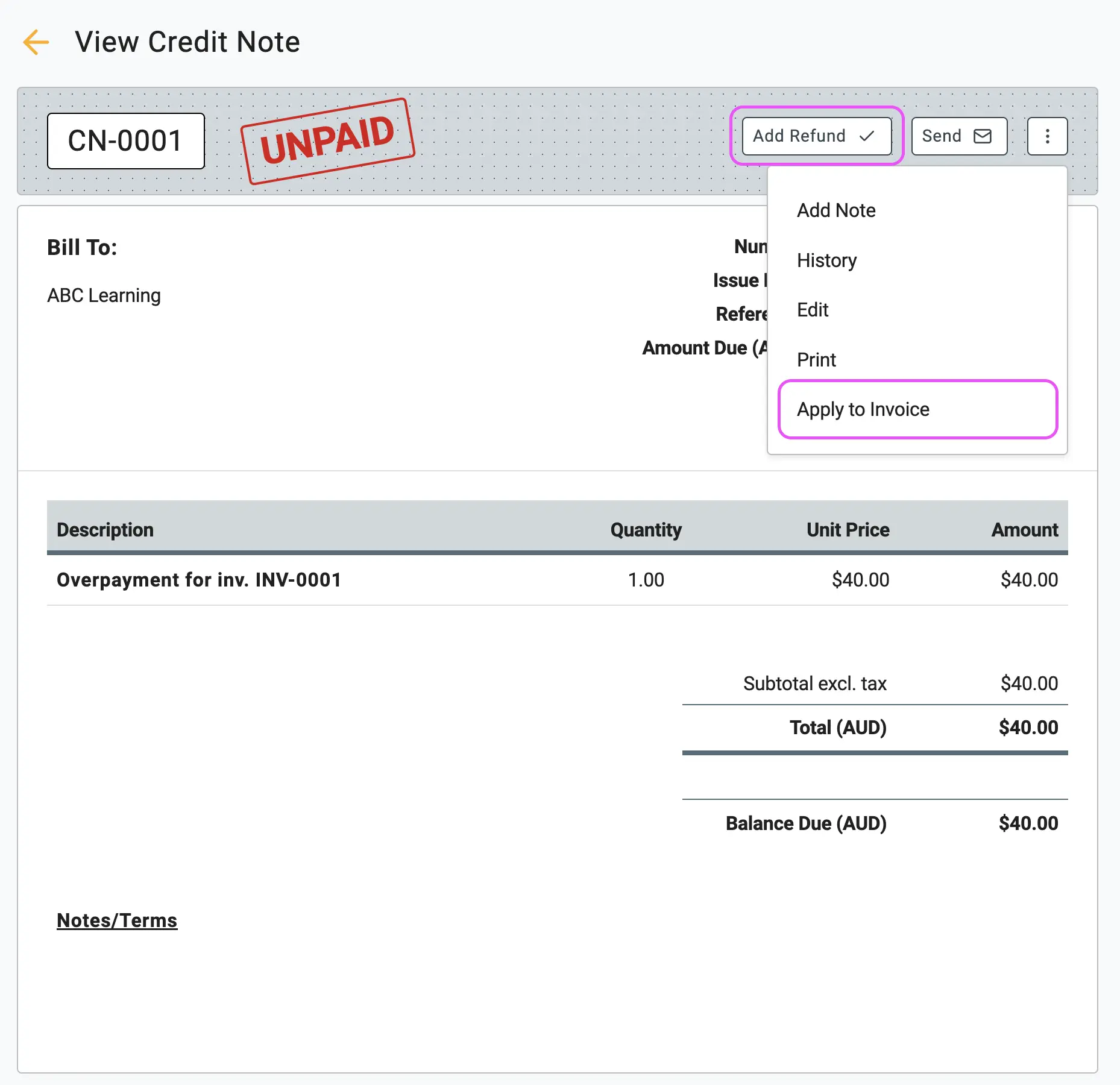

5 Now that the overpayment is saved in the system, it acts just

like a

Credit Note! You can open the overpayment document and select either

Add Refund

(to give the cash back to the customer) or Apply to Invoice

(to use the $40 toward their next bill).

🖇️ Notes

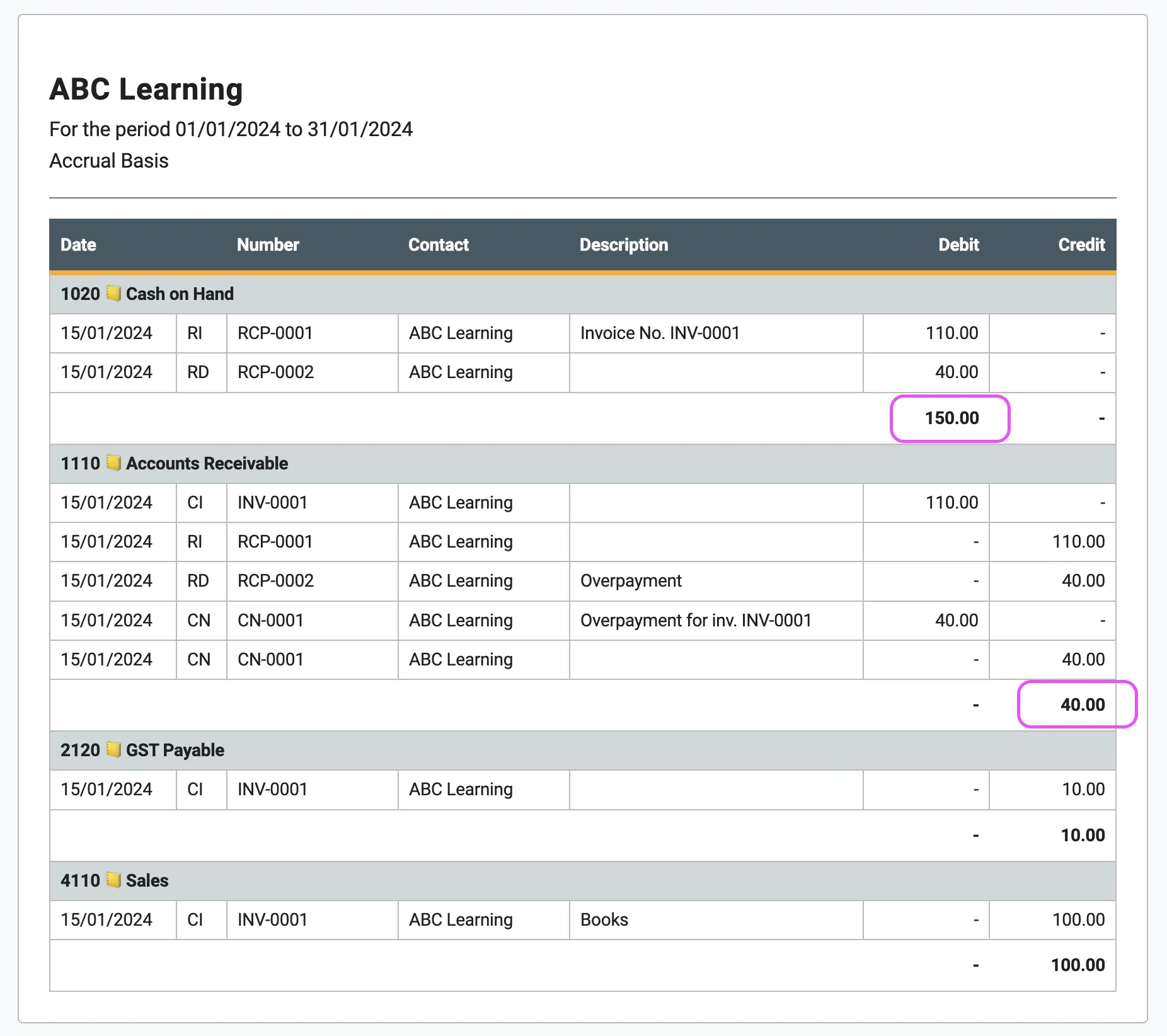

Take a moment to understand how overpayments affect your books. The same rules apply whether you are receiving an overpayment from a customer or making an overpayment to a supplier:

- Tax Warning – Overpayments are not subject to tax because they are not considered revenue yet (you haven't provided a service for that extra money).

- General Ledger – Once you finish these steps, your Bank Account will correctly show the full cash deposit ($150), and your Accounts Receivable will update to show that the customer has a credit balance.

- Supplier Overpayments – Did you accidentally overpay a bill to a supplier? You can follow these exact same steps! You will just do it on the Purchases/Payables side of Gimbla instead of the Sales side.