Opening bank balance

Entering an opening bank balance is as simple as creating a new receipt from your bank. This will increase the bank balance from the receipt date.

⚠️ Important: The opening balance should not be recorded as a journal entry.

🧭 Navigate To

👣 Walkthrough

For this example, we enter $100 as our opening bank balance on 3rd July 2025.

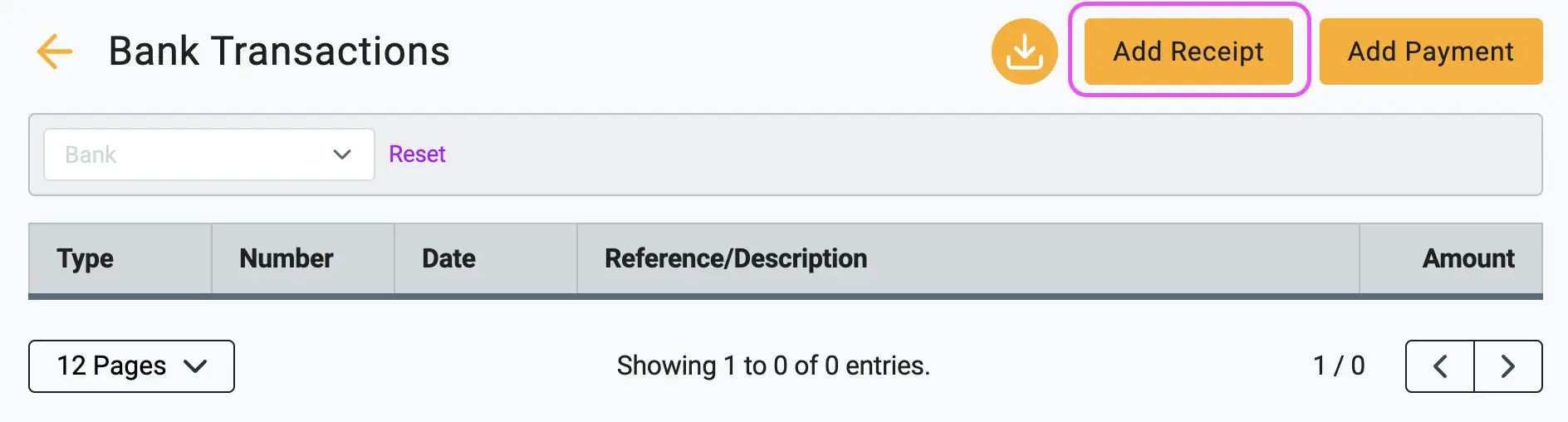

1 Click on the Add Receipt button in your bank transactions.

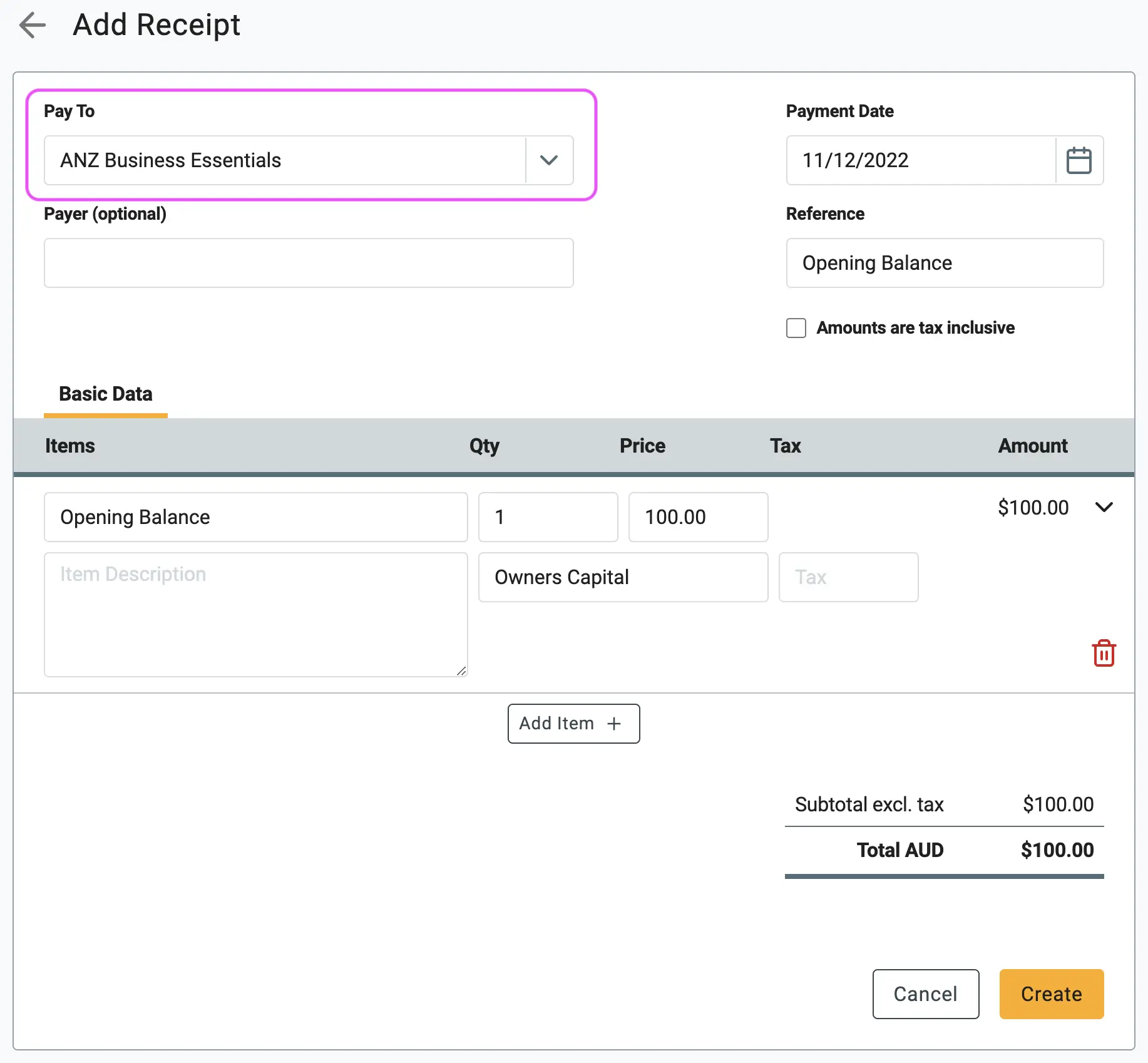

2 Fill out the form

- Description: Enter "Opening Balance."

- Price: Enter the starting balance amount (e.g., 100.00).

- Account: Select an Equity account from your Chart of Accounts. Common choices are Owner's Capital or a dedicated Opening Balance Equity account.

3 Click Create. Your bank balance in the Gimbla system will now reflect the opening amount.

Why use an Equity Account? An opening balance isn't new income; it's money the business already has. By crediting an equity account, you are correctly recording this as the owner's investment or the company's retained capital. This transaction correctly increases your cash (an asset) and your equity, keeping your books perfectly balanced.

🏁 Results

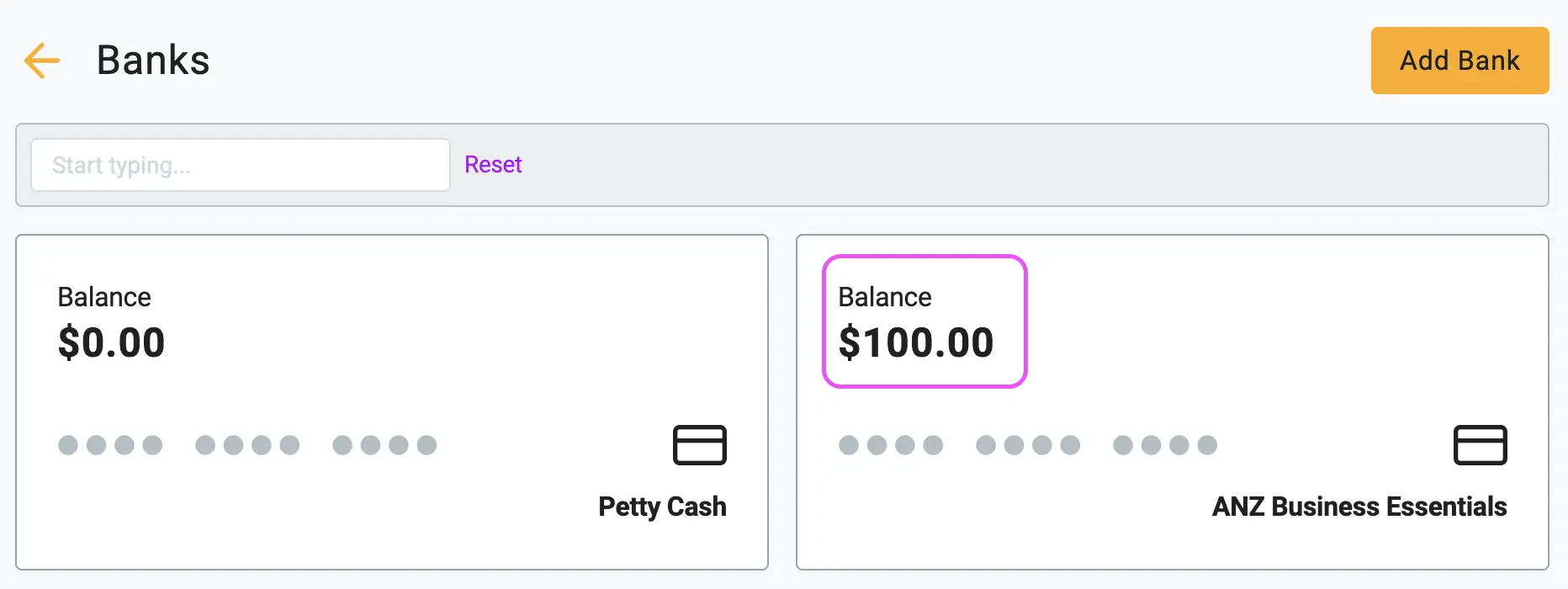

The bank balance in your Gimbla system should now be $100.00.

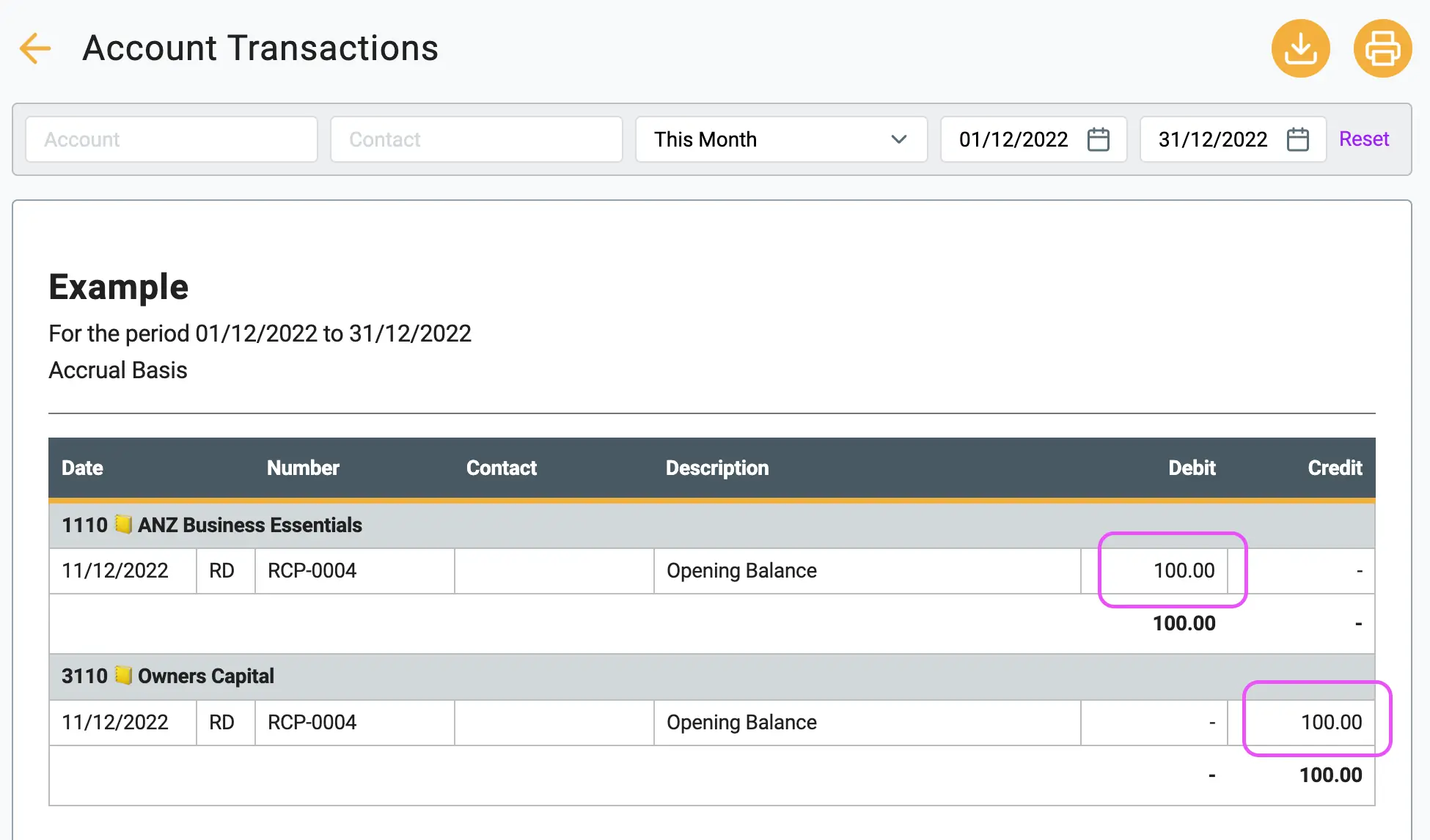

If you look at the account transaction report, you can see the double entry which debits the 1110 - ANZ Business Essentials and credits the 3110 - Owner’s Capital account.

▶️ Video Tutorial

Prefer to watch? Our video guide walks you through the entire process.