Payday Super Ready

What is Payday Super?

Payday Super is upcoming

legislation, expected to pass soon and take effect from July 1, 2026.

It will change how employers pay superannuation, requiring contributions

to be paid at the same time as employee wages, rather than the current

quarterly system.

Current Super Payment Options & Upcoming Challenges

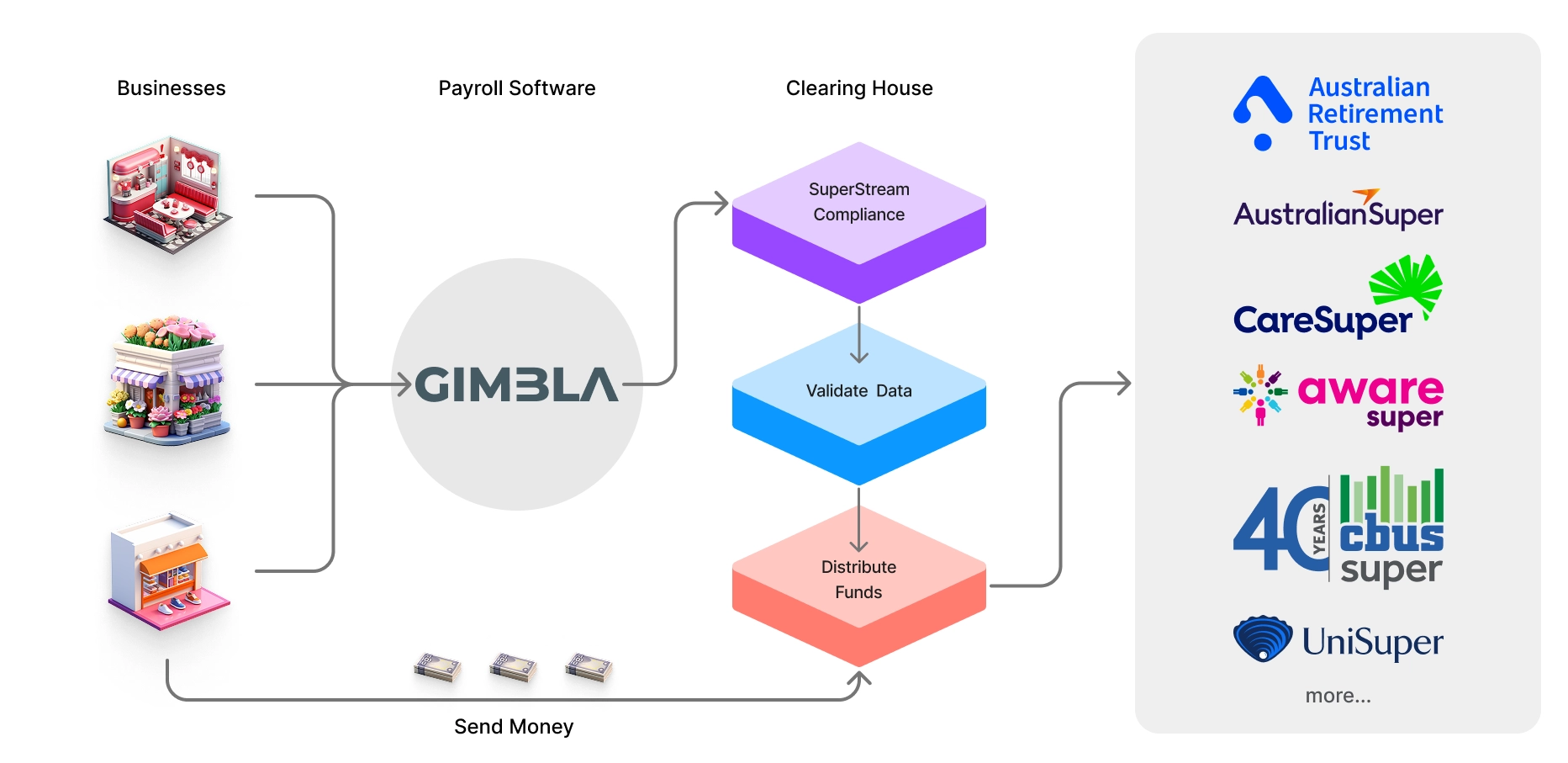

Currently, you might pay super by downloading a Superannuation Alternate

File Format (SAFF) file and uploading it to an external clearing house,

or by using the ATO's free

Small Business Superannuation Clearing House (SBSCH)

. While these methods work for quarterly payments, they can

become very time-consuming with the more frequent weekly or

fortnightly payments required under Payday Super. Furthermore, the

SBSCH is scheduled to close, making a new solution essential for

many businesses.

Do I Need Payday Super Ready Software?

While not mandatory, using software that is "Payday Super ready" can

save you significant time and streamline your payroll process. With

the July 1, 2026, deadline and the closure of the SBSCH approaching,

adopting a compliant software solution now is a smart move.

Plus

Monthly Fee

$19.95 AUD

Everything in the Starter Plan

Storage for attachments

Multi-currency

Recurring Invoices & Bills

Invoice & Journal Imports

Projects

Email Support

Lodge BAS (AU Only)

Payroll & STP Reporting (AU Only) *

Connected Bank Accounts (up to 2) ^