Record an overpayment

An overpayment occurs when a customer remits an amount exceeding the invoiced sum. Although our system lacks a dedicated feature for managing overpayments, you can manually address this situation by following the outlined procedure.

🧭 Navigation Menu

🏷️ Example: Overpaid an invoice by $40

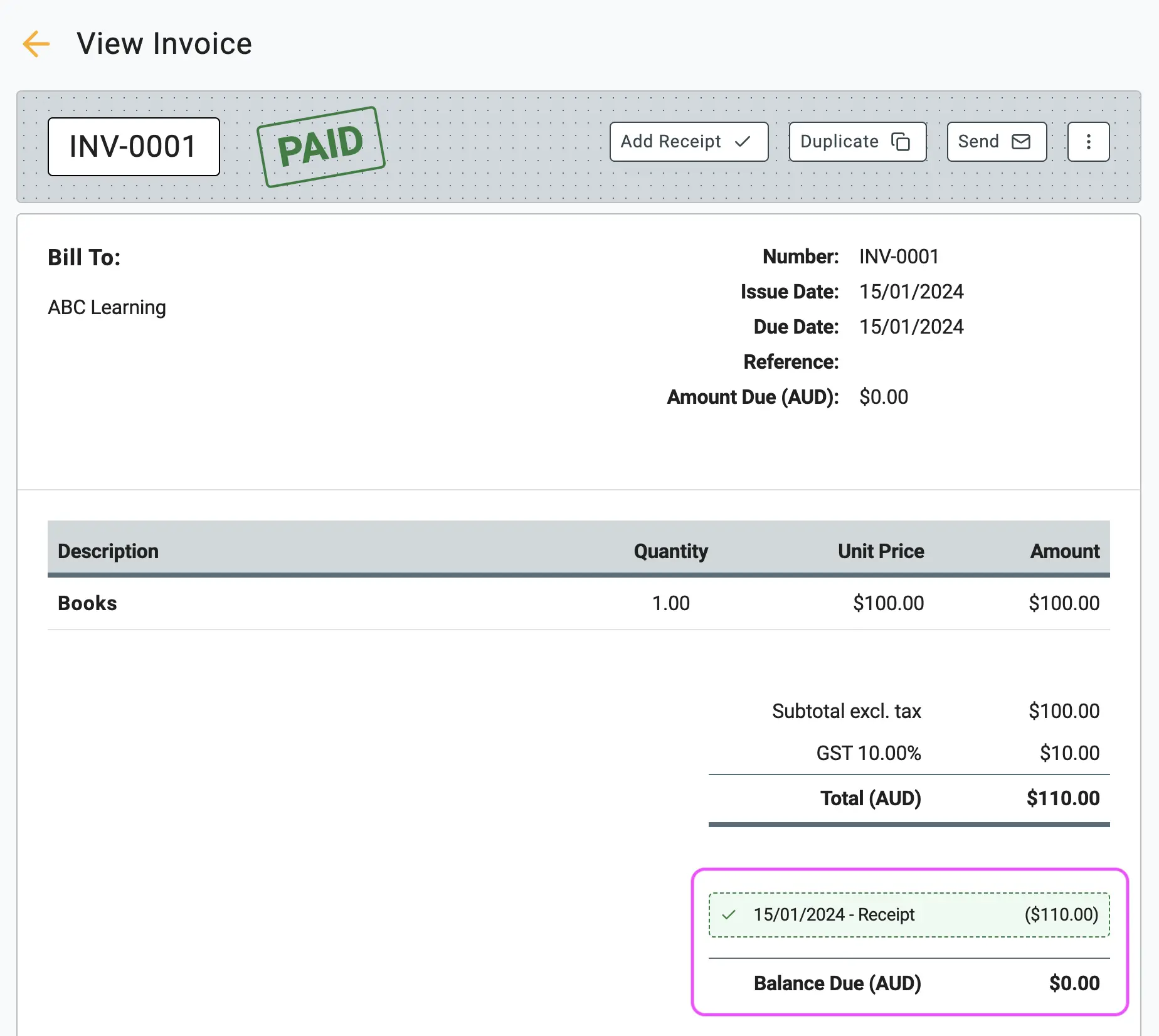

Assuming there's already a $110 invoice in the system, follow these steps to process the overpayment:

1. Record the full payment amount of $110 for the invoice, as usual.

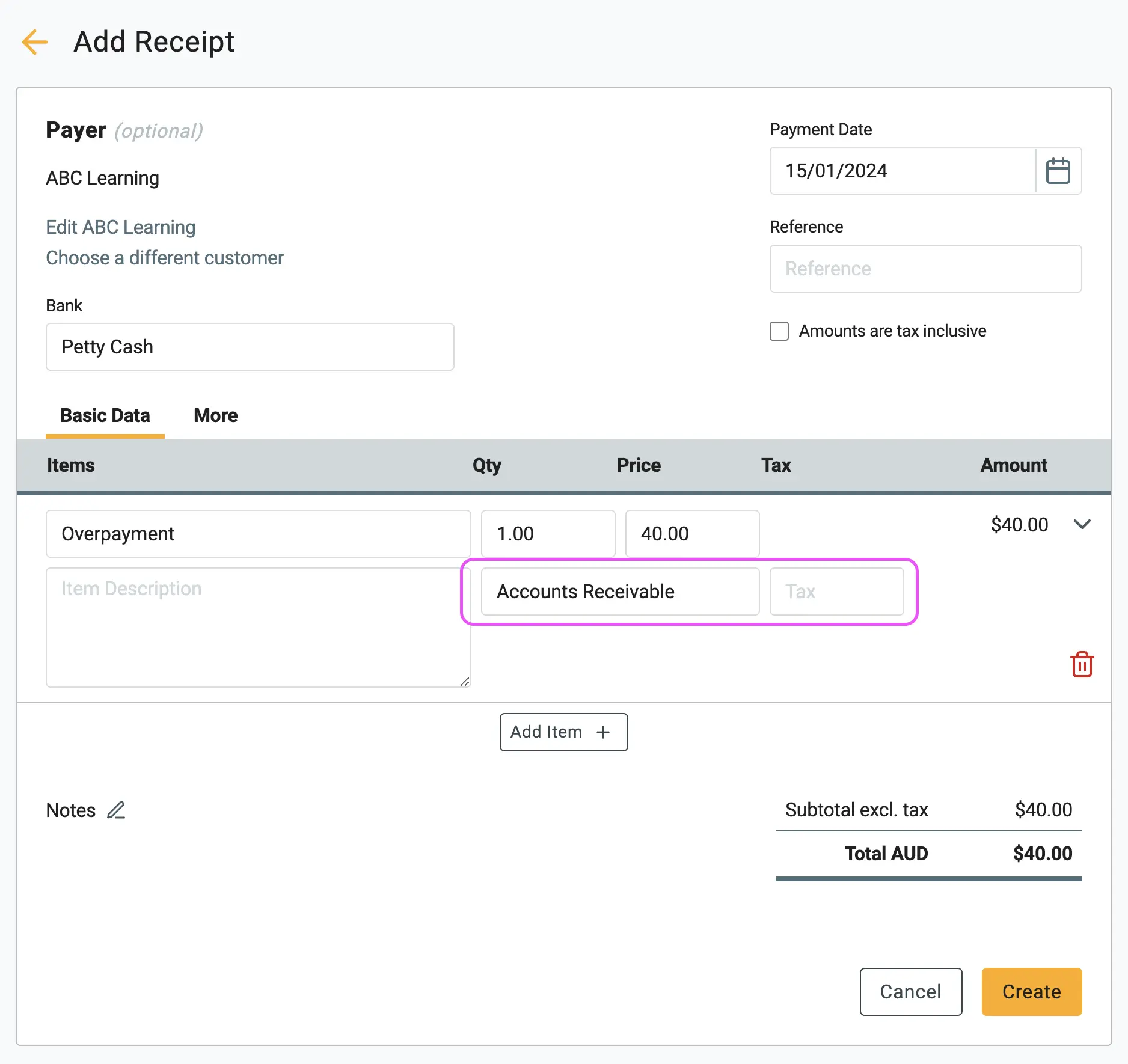

2. Add a Receipt for the remaining $40 overpayment using the direct receipt method. Select the Accounts Receivable account, leaving the Tax Code blank.

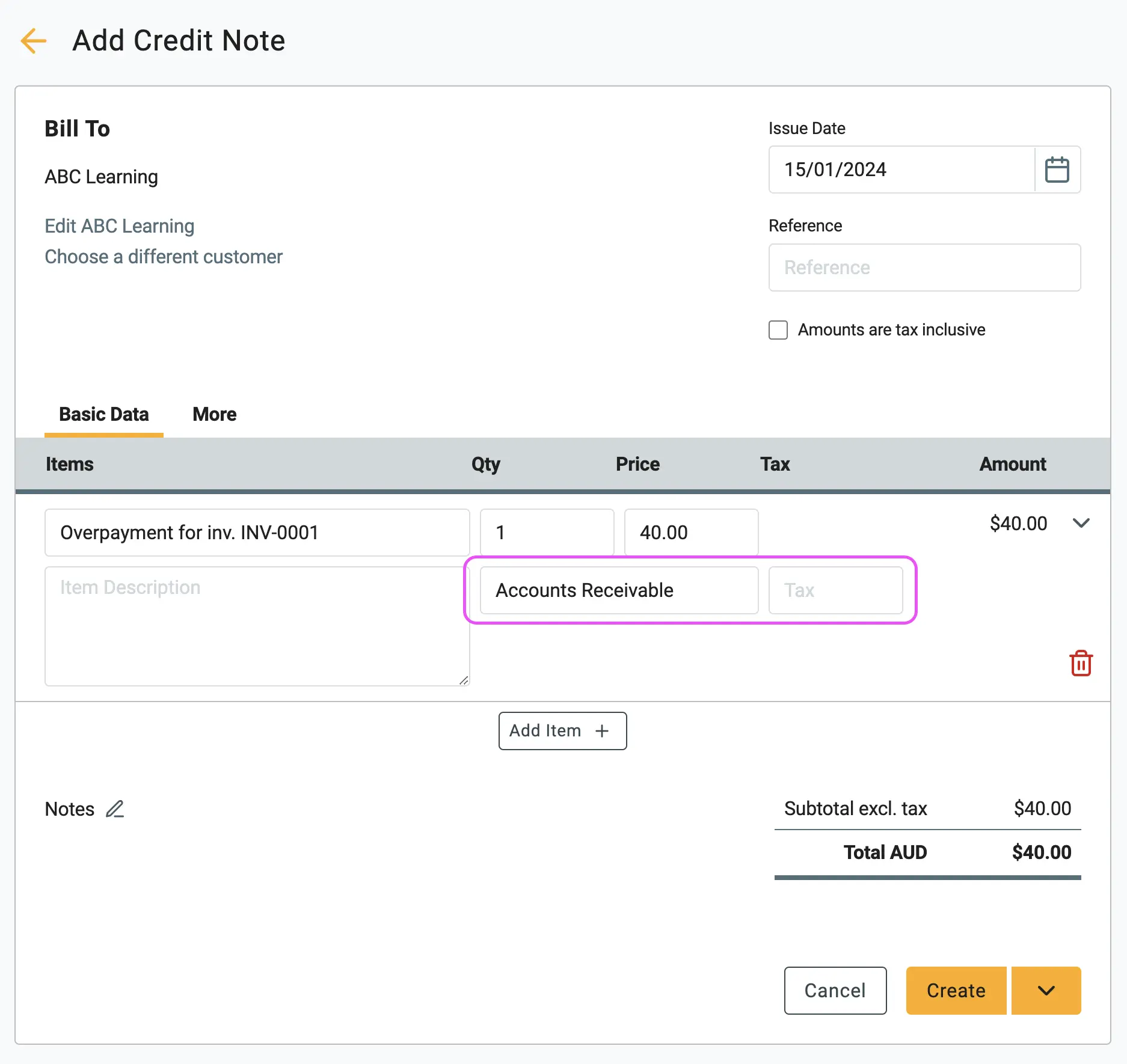

3. Add a Credit Note for the $40 overpayment, using the same Accounts Receivable account. This action offsets the entry made in Step 2.

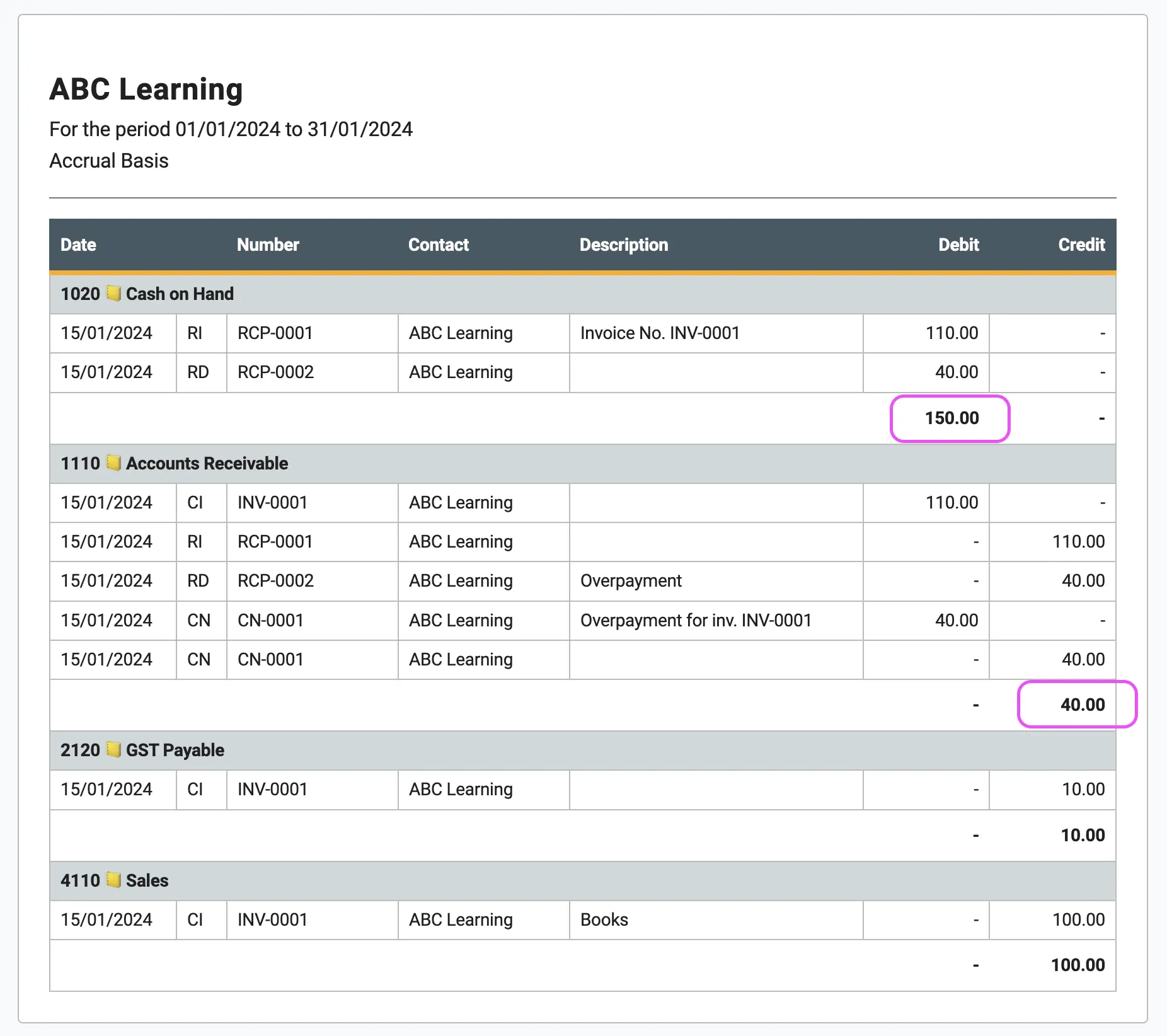

4. Reviewing the account transactions list will reveal the entries recorded in the general ledger. The Bank Account reflects an increase of $150, representing the cash recorded in our system. Simultaneously, Accounts Receivable displays a decrease of $40.

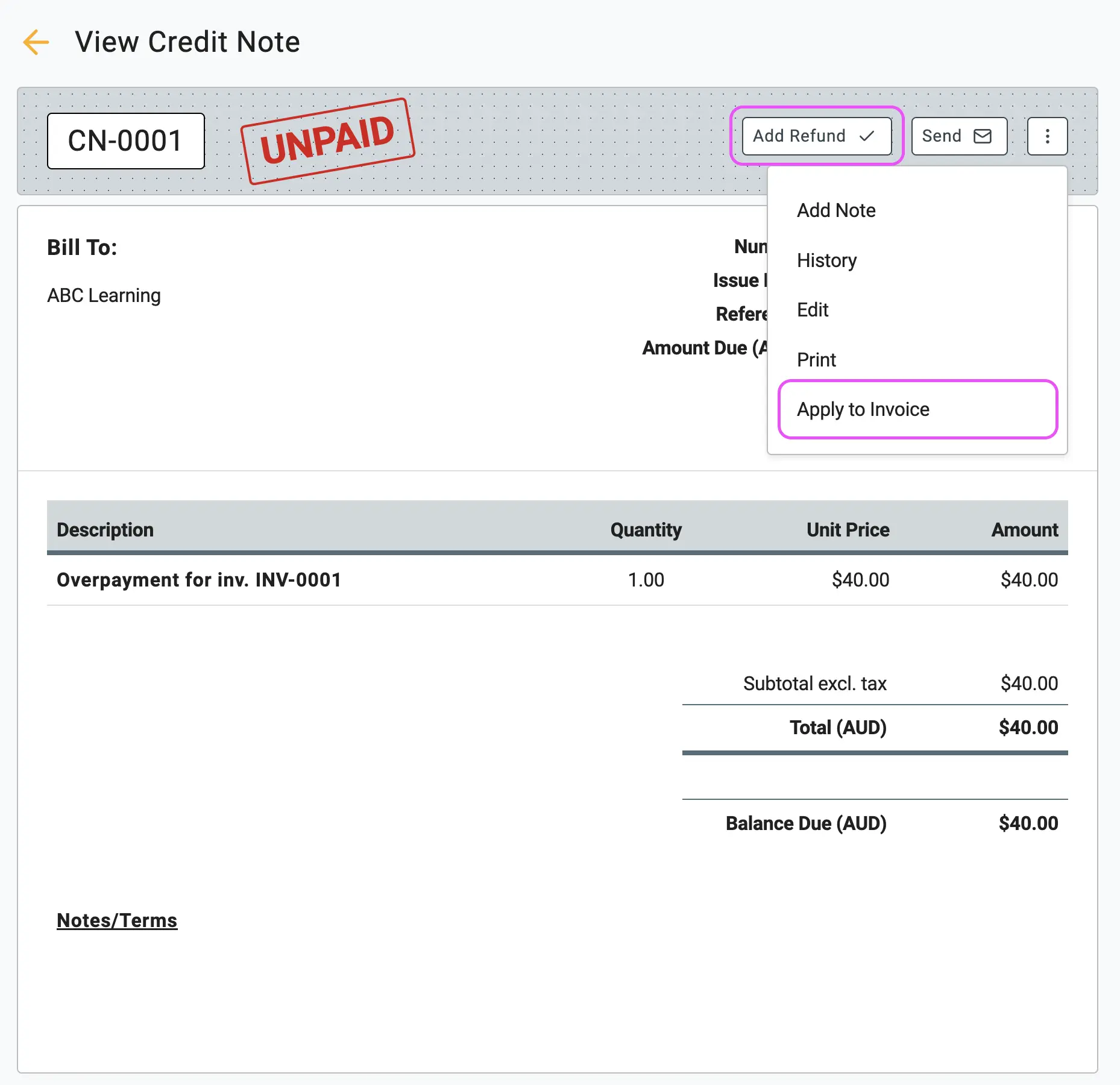

5. To conclude the process, you can proceed with the Credit Note as usual. Choose to either Refund the Customer the overpaid amount or Apply to an Invoice for any outstanding invoices.

🏁 Conclusion

The decision not to incorporate an overpayment feature in our system is driven by the potential complexities arising from the Accrual and Cash methods. Additionally, considering that overpayments are infrequent, we aim to maintain the simplicity of our system.

♻️ Supplier Overpayments (Reverse the Process)

This guide demonstrates how to handle customer overpayments in our system. If you've overpaid a supplier, simply reverse the process:

- Accounts Receivable 👉 Accounts Payable

- Add Receipt 👉 Make Payment

- Credit Note 👉 Debit Note

Warning

Overpayments are not subject to taxation and should not be utilised for anticipated future services or work. This is why it’s important that you leave out the tax code as blank here and increase the Balance Sheet instead of the P&L.